Introduction

The most common mistakes traders should avoid in 2025 are trading without a plan, ignoring risk management, overusing leverage, chasing hype, relying only on tips, and skipping professional education like the best trading course in Chennai. These errors cause most traders to lose money, but with proper planning, discipline, and mentorship, anyone can improve consistency and build long-term success in the stock market.

Common mistakes traders should avoid

Mistake #1: Trading Without a Plan

A trading plan is like a map—it tells you where to start, where to exit, and what risks to take. Without it, traders make random decisions and usually lose money.

Why a Plan Matters

Markets in 2025 move faster than ever. AI bots, algorithmic trading, and global news create sudden volatility. Without a written plan, you’ll chase trades instead of following a strategy.

Example

Rahul, a new trader, entered positions based on tips from social media. Without clear exit rules, he held onto a losing stock until it dropped 40%. A simple plan with stop-loss rules could have saved him.

Solution

- Write down your entry and exit criteria.

- Set stop-loss and profit targets before trading.

- Backtest strategies with historical data.

Mistake #2: Ignoring Risk Management

Risk management is the shield that protects traders from big losses. It ensures that one bad trade doesn’t wipe out your account.

What Is Risk Management?

It means deciding in advance how much you’re willing to lose per trade. Most professionals follow the 1% Rule—never risk more than 1% of your total capital on a single trade.

Case Study

During the 2008 financial crisis, many hedge funds collapsed because they ignored risk exposure. In contrast, disciplined traders who limited losses managed to survive and even profit later.

Solution

- Always set stop-loss orders.

- Use position sizing calculators.

- Hedge risky trades with options when possible.

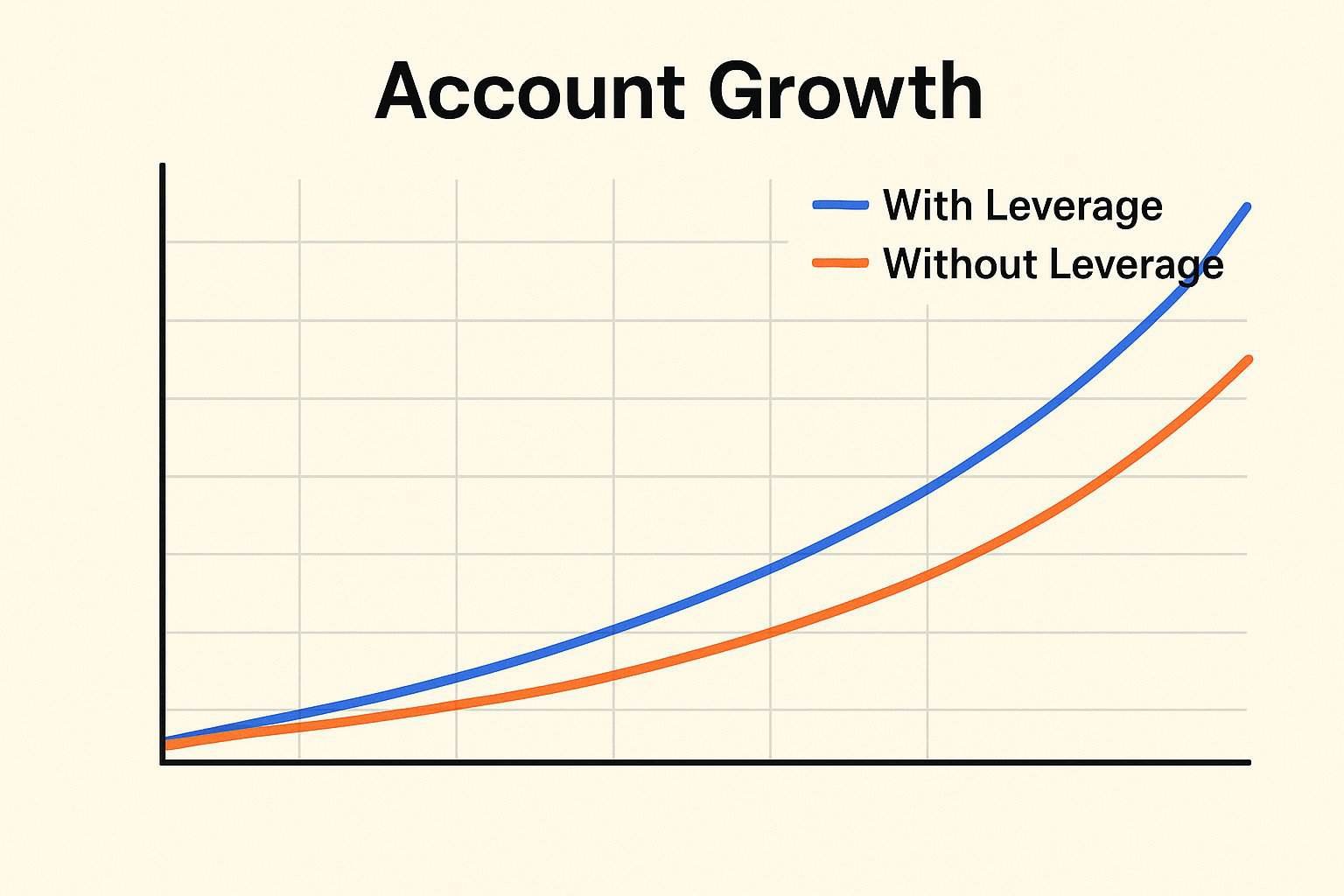

Mistake #3: Over-Leveraging and Margin Misuse

Leverage allows traders to control big positions with little money. But when markets move against you, losses multiply just as quickly.

Example

In the crypto boom, traders using 50x or 100x leverage saw entire accounts vanish with a 1% price swing. The same risk applies to stocks and futures in 2025.

Case Study (India)

A retail trader in NSE futures used excessive leverage. A single gap-down opening caused a ₹5 lakh overnight loss.

Solution

- Keep leverage low (2x–5x max).

- Avoid margin trading until you gain experience.

- Remember: leverage magnifies both profits and losses.

Mistake #4: Chasing Market Hype

Social media platforms like Twitter, Reddit, and Telegram spread stock “hot tips” at lightning speed. Traders who follow hype usually buy at the top.

Example

During the GameStop rally of 2021, late buyers lost big after the hype faded. In 2025, AI bots make these pump-and-dump cycles even faster.

Solution

- Avoid buying just because “everyone is talking about it.”

- Check fundamentals and technical charts first.

- Ask yourself: Would I buy this without social media influence?

Mistake #5: Neglecting Research and Analysis

Trading without research is gambling. You need both fundamental analysis (earnings, news, macro trends) and technical analysis (charts, indicators).

Example

A trader bought a penny stock based on a friend’s tip. A week later, the company announced huge losses. The stock crashed 60%.

Tools for Research in 2025

- AI scanners like TrendSpider and QuantConnect

- NSE company filings

- Global macroeconomic updates

Solution

- Read quarterly results before buying.

- Use technical charts to time entries.

- Combine multiple forms of analysis.

Mistake #6: Failing to Adapt to Changing Markets

Markets evolve. Pandemic stocks rose in 2020, cryptos boomed in 2021, and inflation shaped 2022–23. In 2025, AI-driven volatility dominates.

Example

A trader used the same swing trading strategy for years. But increased volatility in 2024 destroyed his system because he didn’t adjust stop-loss sizes.

Solution

- Review your strategy every few months.

- Track changes in market volatility.

- Be flexible—what worked last year may not work now.

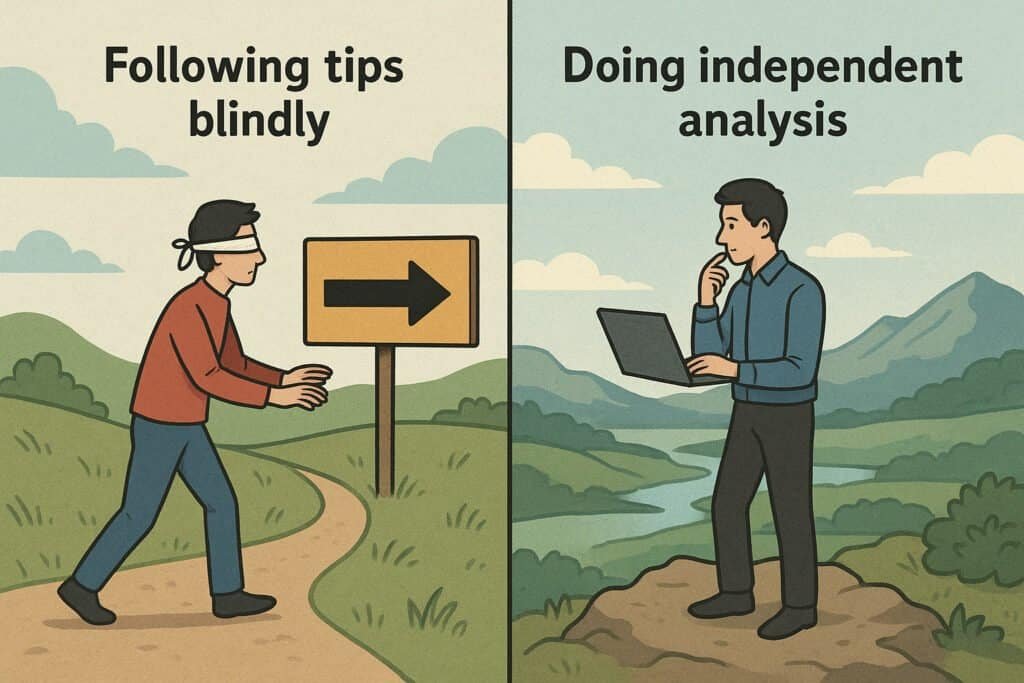

Mistake #7: Relying Only on Tips and Signals

Many traders blindly follow paid signals or copy-trading platforms. This dependency prevents them from learning.

Example

Ankit subscribed to a Telegram signal group. He made money briefly, then lost everything when the group shut down.

Solution

- Learn to make independent decisions.

- Use signals only for reference.

- Build your own trading framework.

Mistake #8: Emotional Trading

Fear and greed ruin traders more than bad strategies do. Emotional decisions lead to:

- Revenge trading after losses

- Holding losing positions too long

- Exiting winning trades too early

Example

After three losing trades, Meena doubled her position size to “win back” money. She ended up with an even bigger loss.

Solution

- Keep a trading journal.

- Avoid trading when angry or stressed.

- Stick to your plan regardless of emotions.

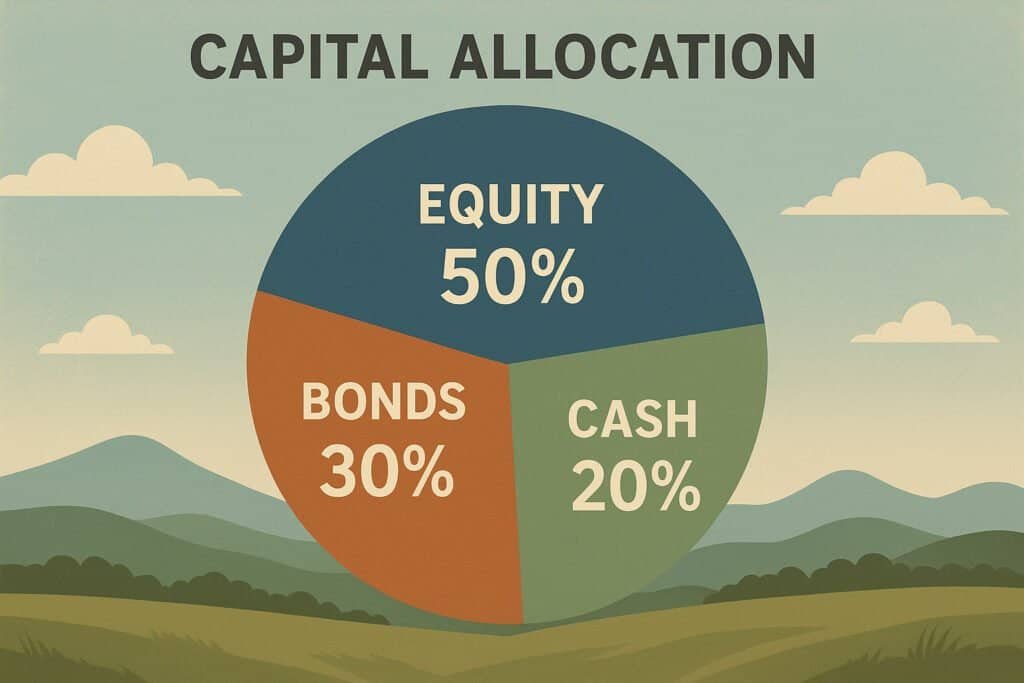

Mistake #9: Poor Money Management

Even good strategies fail without proper money management. Many beginners risk most of their capital on one or two trades.

Case Study

A trader put 90% of his account into one stock. When it fell 20%, he nearly lost everything.

Solution

- Diversify across sectors and asset classes.

- Keep a cash reserve for emergencies.

- Think long-term compounding, not quick wins.

Mistake #10: Skipping Professional Education

Many traders jump into the market with no training, relying only on YouTube or tips. This leads to years of costly mistakes.

Example

Karthik lost money for two years before enrolling in a trading course in Chennai. Within six months of structured learning, he improved his discipline and profitability.

Why Education Matters in 2025

- AI-driven markets are complex.

- Professional mentorship provides structure.

- Courses teach risk control and strategy in real time.

If you’re serious about success, joining the best trading course in Chennai can give you the skills to avoid these mistakes.

Supporting Paragraphs

Professional Mentorship Through the Best Trading Course in Chennai

One of the biggest reasons traders repeat mistakes year after year is the lack of structured guidance. Watching free videos or following random tips online rarely builds consistency. This is where enrolling in the best trading course in Chennai makes a real difference. Professional mentors not only teach technical and fundamental analysis but also guide students on risk control, trading psychology, and money management. With live market practice and personalized feedback, traders can avoid common errors like over-leveraging, chasing hype, or emotional decision-making.

Why Choosing the Best Trading Institute in Chennai Matters for 2025

The trading landscape in 2025 is far more complex, with AI-driven tools, global volatility, and faster market reactions. To succeed, beginners and experienced traders alike need practical, hands-on training that goes beyond theory. The best trading institute in Chennai provides a structured environment where learners can test strategies in simulators, practice paper trading, and get exposure to real-time market conditions. This reduces the trial-and-error approach and equips traders with the discipline and confidence needed to avoid costly mistakes.

Conclusion

Trading in 2025 offers huge opportunities, but success depends on avoiding the most common mistakes. Whether it’s trading without a plan, misusing leverage, chasing hype, or skipping proper education, each error can be costly.

The good news? Every mistake can be prevented with discipline, research, and mentorship. By learning risk control, adapting strategies, and investing in structured training like the best trading course in Chennai, traders can move closer to consistent profitability.

If you’re serious about avoiding costly trading mistakes and want expert guidance, reach out to us today to learn more about the best trading course in Chennai and start your journey toward consistent success.