GOLD TODAY'S TRADING LEVELS - Entry, Exit and Stoploss

🟩 BUY SIGNAL (NOT SAFE)

Entry: 3260

Stop Loss: 3248

Target: 3310

Current Market Price (CMP): 3273

🔹 Risk-Reward Ratio (RRR):

- Risk: 3260 - 3248 = 12 points

- Reward: 3310 - 3260 = 50 points

- RRR = 50 / 12 ≈ 4.16

📘 Explanation:

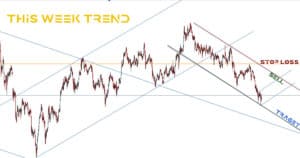

- Buying now is not safe because the market is in a downtrend.

- This signal had a good RRR at the time of entry, but the downtrend limits upside potential.

🔻 SELL SIGNAL - SAFE

Entry: 3310

Stop Loss: 3352

Target: 3195

Current Market Price (CMP): 3273

🔹 Risk-Reward Ratio (RRR):

- Risk: 3352 - 3310 = 42 points

- Reward: 3310 - 3195 = 115 points

- RRR = 115 / 42 ≈ 2.74

📘 Explanation:

- CMP is currently below the SELL entry zone, so wait for a pullback to 3310 for proper entry.

- Trend remains bearish; this setup offers a favorable RRR if entry zone is retested.

🛡️ Gold Fundamentals – June 30, 2025 (XAU/USD)

1. 🧭 Macro & Safe‑Haven Drivers

Global uncertainty—including recent U.S.–China trade discussions and Middle East developments—continues to bolster gold’s safe‑haven appeal.

Despite mild strength in equity markets, caution prevails as traders anticipate U.S. macro data this week (PCE inflation, non-farm payrolls).

Gold remains underpinned by demand from risk-off sentiment and ongoing geopolitical tension.

2. 💹 Inflation & U.S. Data Outlook

Markets await the U.S. core PCE inflation reading, expected at 2.3% YoY, a key driver of Federal Reserve policy tone.

With Fed rate cut bets increasing for September (~75% probability), gold could find further support if data weakens the dollar.

3. 📈 Sentiment & Trade Setups

- FX.co trade view:

- Buy above $3,250 (target: $3,281)

- Sell below $3,320 (target: $3,203)

- Sentiment remains neutral to bearish, with traders watching for directional confirmation around key macro events.

4. ⚠️ Risks & Headwinds

- A resilient U.S. dollar may cap upside.

- Stronger-than-expected macro data (jobs, inflation) could weigh heavily on gold.

- Global bond yields remain elevated, reducing short-term gold appeal.

✅ Summary & Strategy

Gold is range-bound but fundamentally supported by inflation concerns, dovish Fed outlook, and geopolitical instability.

- Bias: Neutral to bearish short-term

- Strategy:

- Buy dips near $3,260 if price holds

- Sell rallies near $3,300 if momentum weakens

🔍 Watch Levels

- Resistance: $3,300 –$3,320

- Support: $3,195–$3,210

- Target Zones:

- 🟩 Long: $3,300 –$3,320

- 🔻 Short: $3,195–$3,210

⚠️ Important Note

With U.S. macro data and Fed commentary due, price volatility is expected. Stay alert to dollar moves and use risk control in live trades.

⚠️ Disclaimer

This report is for informational purposes only. It does not constitute financial advice. Always consult a qualified advisor and perform your own analysis before trading.

Topic Covered:

gold price today, XAUUSD analysis, gold market report, gold trading outlook, gold news June 30 2025, gold fundamental analysis, gold technical setup, gold buy sell levels, gold price forecast, gold support resistance, gold trading signals, gold sentiment, US inflation impact on gold, Fed policy gold, gold and dollar correlation, central bank gold demand, PCE data gold impact, gold investment outlook, gold price June 30 2025