Strategic Trading: Eliminate Emotion from Execution

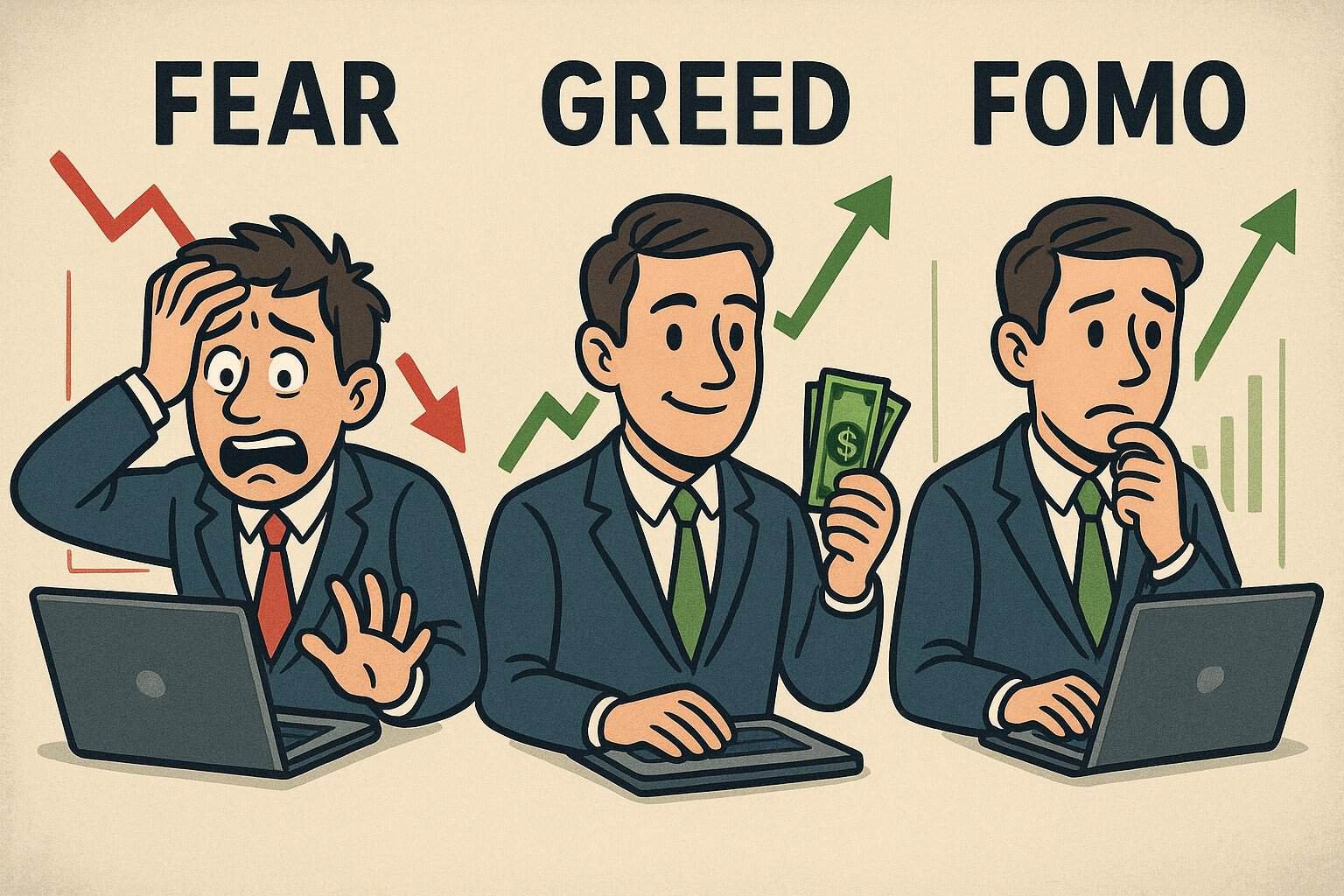

Strategic trading is the key to long-term success because it helps traders follow a clear plan and avoid emotional decisions, and the best way to learn this skill is through the best trading course in Chennai offered by a reputed stock market institute. By removing emotions like fear, greed, and FOMO from execution, traders gain discipline, reduce losses, and make smarter, consistent decisions that work across all market conditions.

Strategic trading

What Is Strategic Trading?

Strategic trading means using a well-defined plan instead of reacting to market emotions. It focuses on logic, rules, and discipline rather than fear or greed. A trader with a strategy knows when to enter, when to exit, and how much risk to take—without second-guessing or panicking.

Unlike emotional trading, where decisions are based on analysis and structure., it creates consistency and improves long-term results.

Why Emotions Are Dangerous in Trading

Markets move fast, and emotions often push traders into costly mistakes. Fear can make you exit too early, while greed may tempt you to hold losing positions longer than necessary. Some common emotional mistakes include:

- Revenge trading after a loss

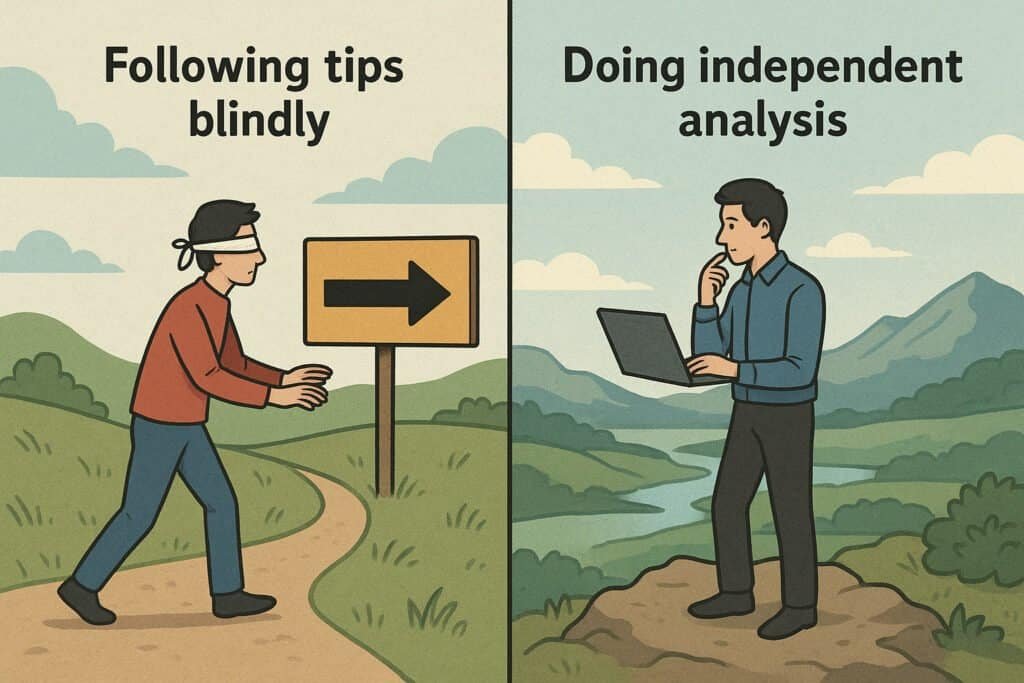

- Chasing hype or tips without analysis

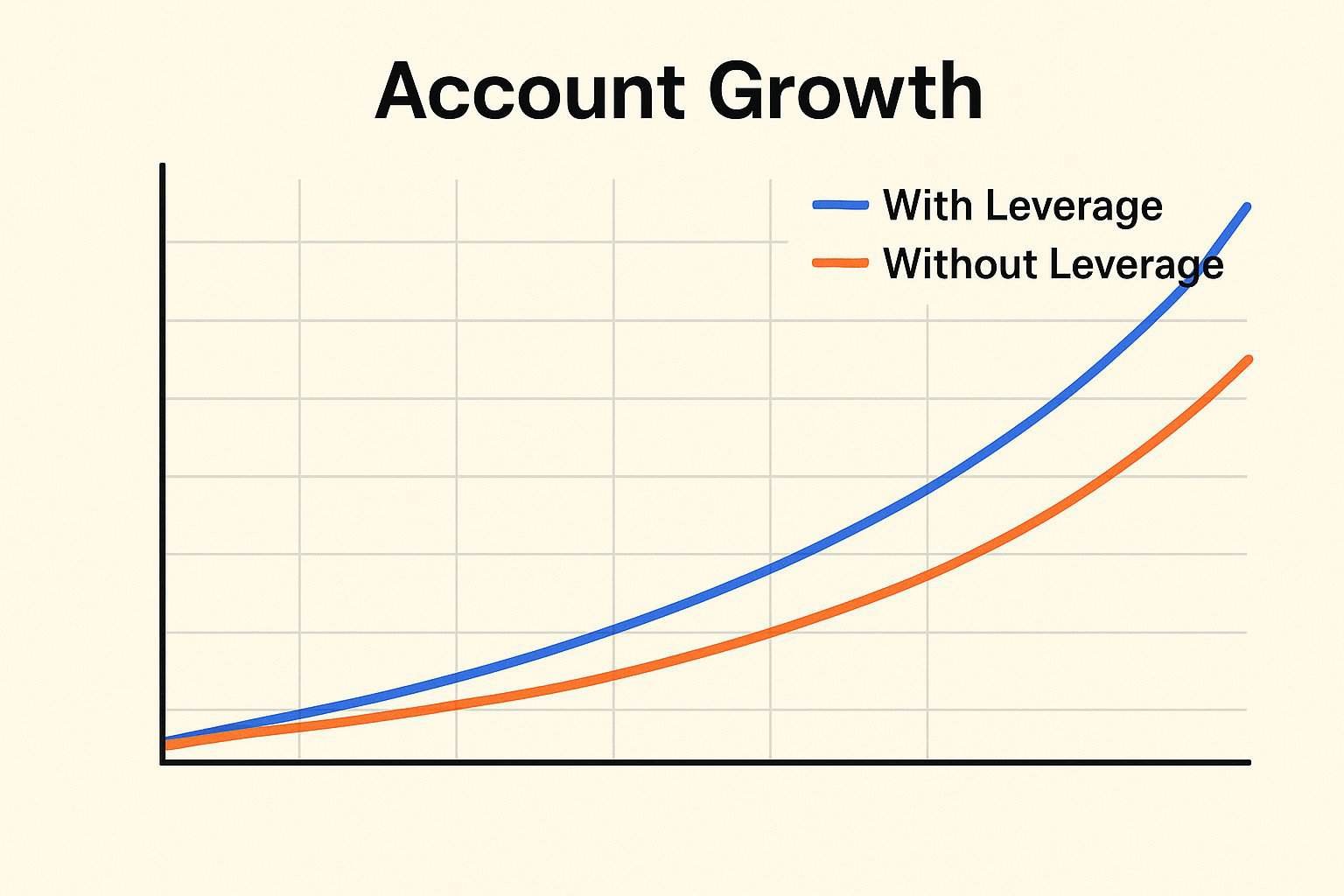

- Overleveraging in the hope of bigger returns

- Closing winning trades too early due to panic

These patterns often lead to poor results.This trading prevents them by sticking to clear rules.

Key Principles of Strategic Trading

To succeed, traders need discipline and structure. Some principles include:

- Follow a trading plan with defined entry and exit rules

- Set a risk/reward ratio before entering trades

- Maintain a trading journal to review performance

- Backtest strategies to confirm reliability before live trading

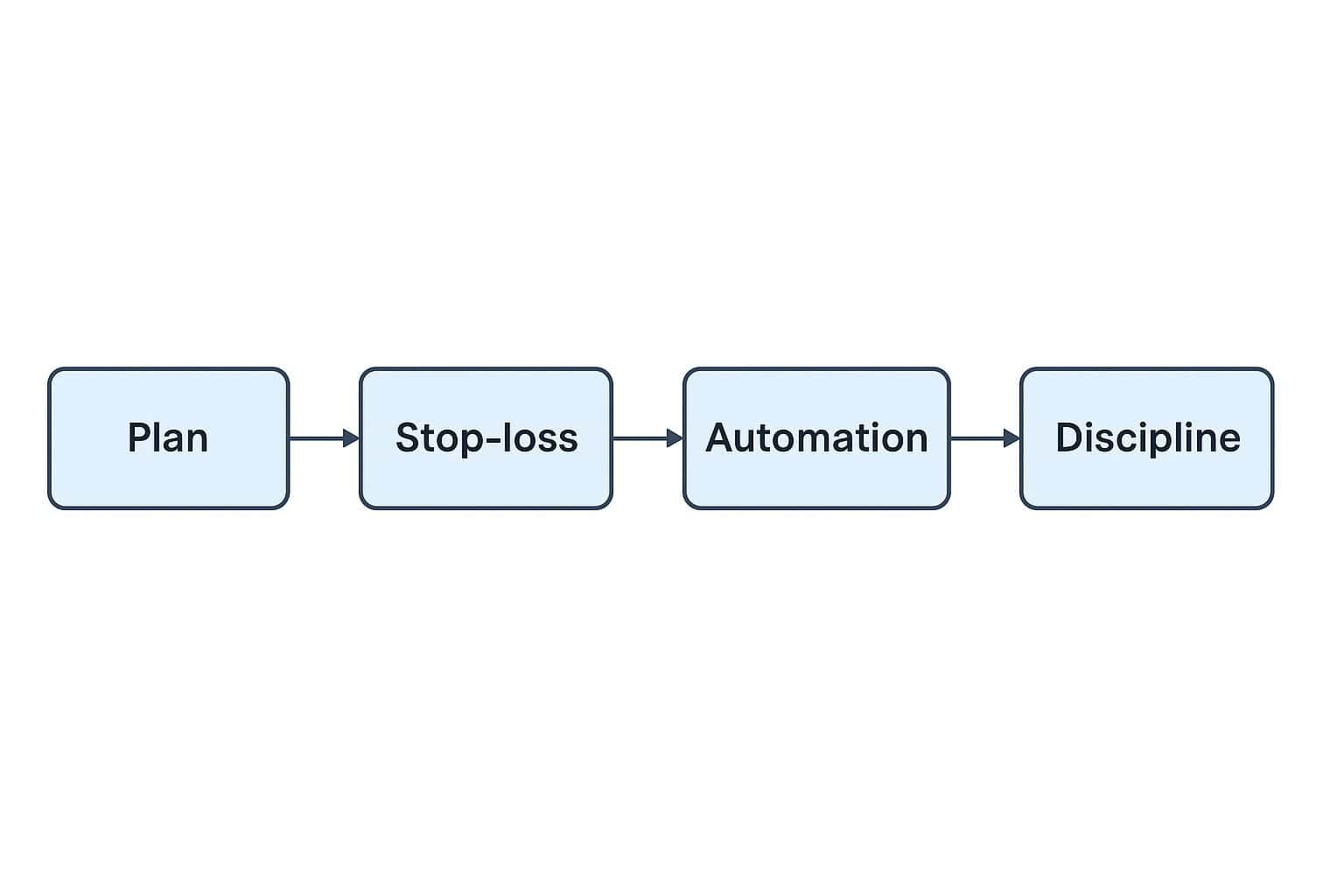

How to Eliminate Emotion from Execution

Here are simple steps to keep emotions out of trading:

- Write down your plan – include entry, exit, and risk levels.

- Use stop-loss and take-profit orders – to avoid panic decisions.

- Automate execution with tools when possible.

- Practice discipline techniques – such as meditation, scheduled breaks, or limiting screen time.

Over time, these steps train you to trust the system, not emotions.

Role of Trading Education and Mentorship

Self-learning is important, but it often lacks structure and accountability. That’s why many traders benefit from joining a stock market institute or enrolling in the best trading course in Chennai.

Such institutes provide:

- Live market training

- Real-time mentorship

- Emotional control lessons

- Practical strategy sessions

This guidance helps traders avoid years of trial and error.

Tools & Techniques for Strategic Trading

Strategic traders often use:

- Technical analysis tools like charts and indicators

- Risk calculators to manage exposure

- Paper trading platforms for safe practice

- AI-driven analysis tools for unbiased decisions

These tools reduce reliance on emotions and allow traders to trust data-driven choices.

Strategic Trading Across Market Types

Strategic methods can be applied to:

- Stocks – choosing trades based on trends and fundamentals

- Futures & Options – using strategies like spreads and hedges

- Forex – applying strict risk control due to high volatility

- Crypto – managing risk where emotions run high

Common Mistakes to Avoid

Traders should watch out for:

- Ignoring their own plan

- Overtrading without discipline

- Poor risk management

- Blindly copying others

These mistakes usually stem from emotions and lack of structure.

Building a Long-Term Strategic Trading Mindset

Successful traders think in years, not days. To build this mindset:

- Focus on consistency, not overnight profits

- Keep a journal to track progress

- Learn continuously from trusted sources

- Join a trading institute in Chennai or an online mentorship program to sharpen skills

Strategic Trading Success Stories

Many professionals and beginners have turned consistent only after adopting a structured approach. For example, engineers and IT professionals in Chennai who joined a stock market institute reported fewer losses and better discipline because they learned risk management, technical skills, and emotional control.

Why the Best Trading Course in Chennai Matters for Beginners

For beginners, trading can feel overwhelming because of constant market fluctuations and the pressure of decision-making. While self-study provides basic knowledge, it often fails to build the emotional discipline required for consistent success. This is where the best trading course in Chennai plays a major role. A reliable trading institute in Chennai doesn’t just teach technical charts—it trains you to follow a structured process, practice with real-time case studies, and build risk-managed strategies. With mentorship and hands-on sessions, traders learn to stick to their plan and eliminate emotions from execution, which is the core of strategic trading.

How a Stock Market Institute Builds Discipline and Strategy

A trusted stock market institute provides more than theoretical lessons—it builds trading discipline, emotional control, and long-term consistency. Professional mentors guide learners through live markets, correcting mistakes in real time and teaching strategies that can adapt to changing market conditions. The best trading course in Chennai also ensures students practice with simulators, journals, and performance reviews. This structured learning path transforms random trading into a systematic process, helping traders grow steadily and avoid the common emotional traps that derail most beginners.

Action Plan for Beginners

- Learn the basics of markets

- Practice with paper trading

- Enroll in a trading institute in Chennai for structured guidance

- Apply risk management rules

- Scale up gradually once consistent

Ready to master strategic trading and take control of your emotions? Get in touch with our stock market institute in Chennai today to join the best trading course and start your journey toward disciplined, profitable trading

FAQs on Strategic Trading

1. What does strategic trading mean in simple words?

Strategic trading means following a clear, rule-based plan instead of making emotional decisions in the stock market.

2. How can I remove emotions like fear and greed from trading?

You can eliminate emotions by having a written plan, using stop-loss orders, and following risk management strategies.

3. Why do most beginners fail in trading?

Most beginners fail because they trade emotionally, use high leverage, and skip learning from a stock market institute or mentor.

4. What is the best way to start with strategic trading?

Start with small trades, practice on a demo account, and get structured learning from a trading institute in Chennai or online program

5. Can strategic trading guarantee profits?

No strategy guarantees profits, but strategic trading improves consistency and reduces losses compared to emotional trading.

6. How important is psychology in trading success?

Psychology is critical—controlling fear, greed, and FOMO is often more important than technical knowledge.

7. What are common emotional mistakes in trading?

Revenge trading, chasing hype, closing winners too early, and overtrading are common emotional mistakes

8. How does a stock market institute help traders?

A stock market institute provides structured training, mentorship, live practice, and risk management lessons that build discipline.

9. What are the qualities of the best trading course in Chennai?

The best trading course in Chennai offers practical training, live sessions, mentorship, and focus on risk control.

10. How do I choose the right trading institute in Chennai?

Look for institutes with experienced mentors, hands-on training, student reviews, and courses covering both technical and psychological aspects

11. Can beginners benefit from strategic trading?

Yes, strategic trading helps beginners avoid early mistakes and develop disciplined habits from the start.

12. How long does it take to become a successful strategic trader?

On average, it can take 1–2 years with practice and guidance from a mentor or institute.

13. Are trading journals useful for strategic trading?

Yes, journals help track mistakes, improve strategies, and reduce emotional decisions

14. Can AI tools help eliminate emotions in trading?

Yes, AI tools and automated alerts reduce human bias by sticking to pre-set rules.

15. Is paper trading useful for emotional control?

Absolutely—paper trading allows you to practice strategy without risking money, helping reduce panic and greed.

16. Do professional traders still struggle with emotions?

Yes, but professionals manage emotions with discipline, systems, and consistent routines.

17. What’s the difference between emotional trading and strategic trading?

Emotional trading relies on feelings and hype, while strategic trading follows pre-defined rules and risk control.

18. How does risk management support strategic trading?

Risk management sets limits on how much you lose per trade, preventing emotional panic.

19. Is Chennai a good place to learn stock market trading?

Yes, Chennai has several reputed institutes offering structured programs for beginners and professionals.

20. What’s the first step towards becoming a strategic trader?

The first step is education—join a stock market institute or the best trading course in Chennai, then build and practice your trading plan.