Scalping Trading Made Simple: Expert Strategies for Beginners

Scalping trading strategies are short-term trading methods that allow beginners to make multiple small profits in a single day. The fastest way to learn them is through a share market online class, where expert guidance, simple techniques, and risk management strategies help beginners trade efficiently and safely.

Introduction: Learn Scalping Trading Through a Share Market Online Class

Scalping trading strategies are short-term, high-speed trading methods that allow beginners to make multiple small profits in a single day, and the best way to learn them is through a share market online class. By following expert scalping methods and simple techniques, beginners can quickly understand entry and exit rules, manage risk, and develop the discipline needed to succeed in fast-paced markets.

A share market online class provides structured lessons on technical analysis, chart reading, trading psychology, and risk management. Instead of learning through trial and error, beginners gain access to expert scalping methods, live market examples, and practice exercises, which makes scalping trading for beginners much easier.

Why Scalping Trading Is Considered Difficult

Scalping is widely regarded as the most difficult trading style because it demands:

- Ultra-fast decision making – Trades can last seconds to a few minutes.

- High trade frequency – 20–100 trades per day are common.

- Small profit margins – Each trade may yield only 0.1–0.5% profit.

- High transaction costs – Commissions and spreads reduce gains.

- Discipline and focus – Traders must control emotions and follow strict rules.

Beginners often feel overwhelmed, but a share market online class can simplify these concepts by teaching step-by-step scalping trading strategies.

Types of Scalping Trading Strategies

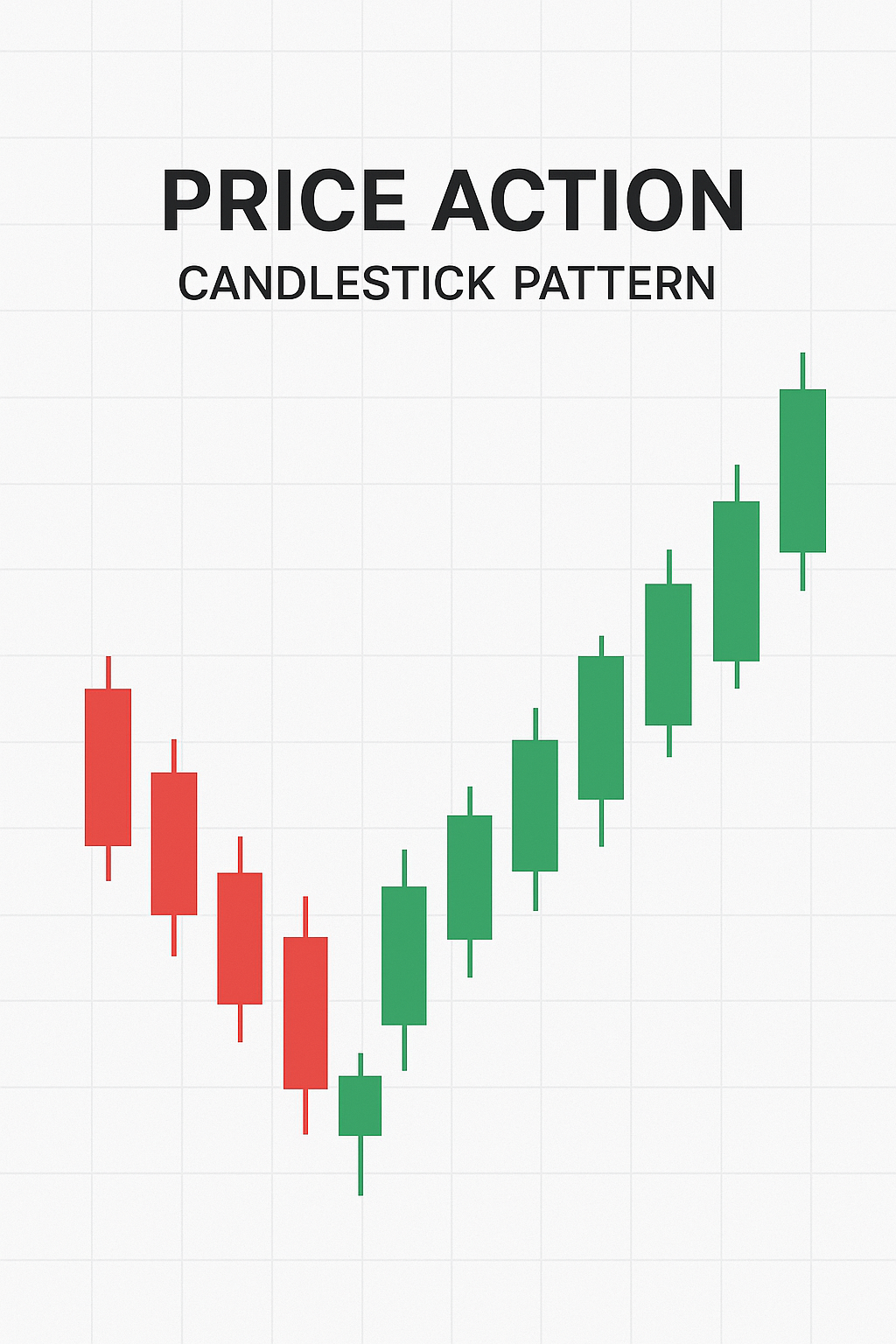

1. Price Action Scalping

- Focuses on candlestick patterns and support/resistance levels.

- Example: If a stock price touches support at ₹1,000 and forms a bullish engulfing candle, a quick buy can be executed, targeting a 0.5–1% profit.

- Ideal for beginners who prefer minimal indicators.

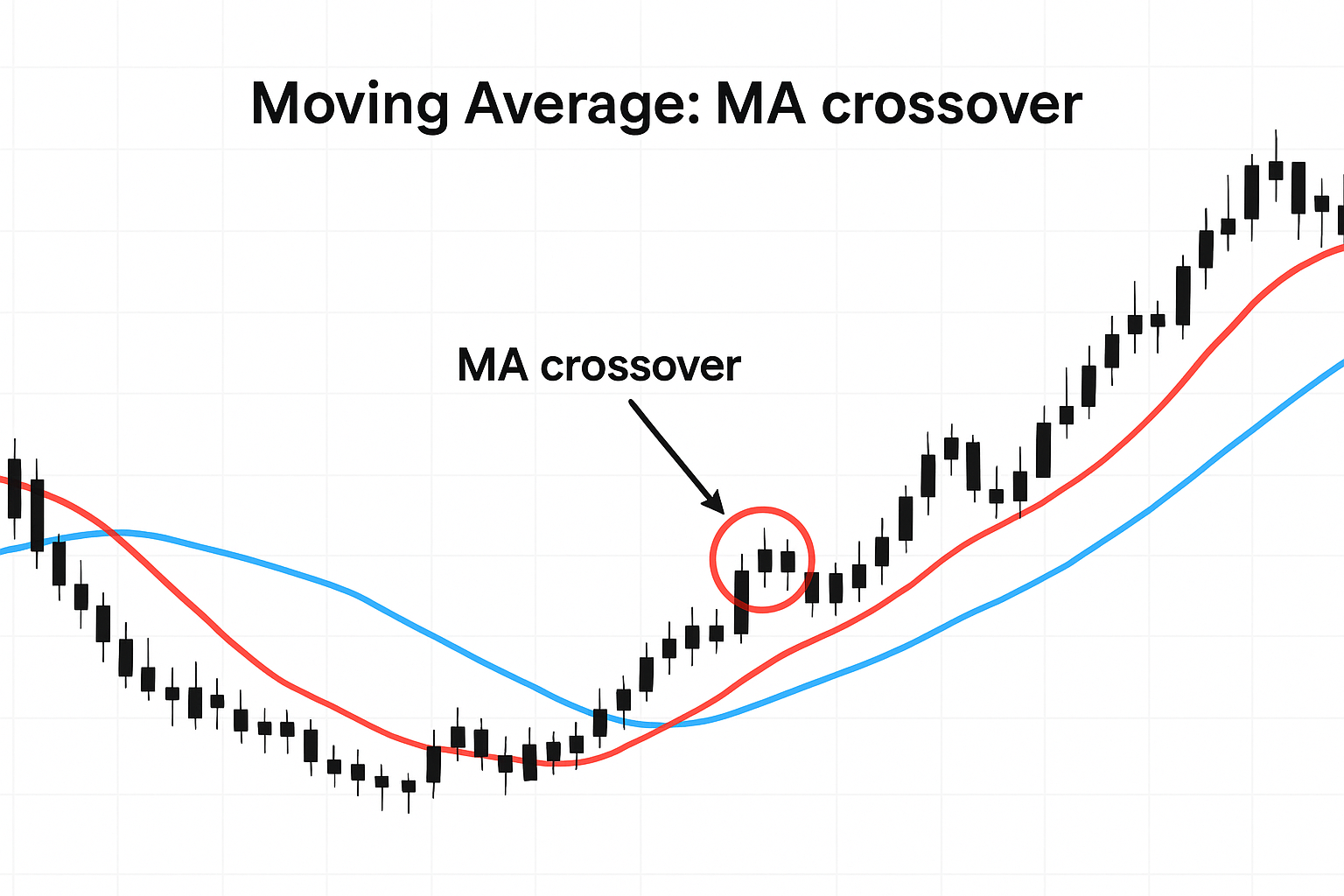

2. Moving Average Scalping

- Uses short-term moving averages like 5-EMA and 20-EMA.

- Example: If the 5-EMA crosses above the 20-EMA on a 5-minute chart, buy; sell when it reverses.

- Works best in trending markets.

3. Momentum Scalping

- Based on sudden price spikes from news or events.

- Example: A company announces quarterly results, and the stock jumps 2% in 10 minutes. Momentum scalpers buy immediately to capture small profits.

- Requires experience and quick decision-making.

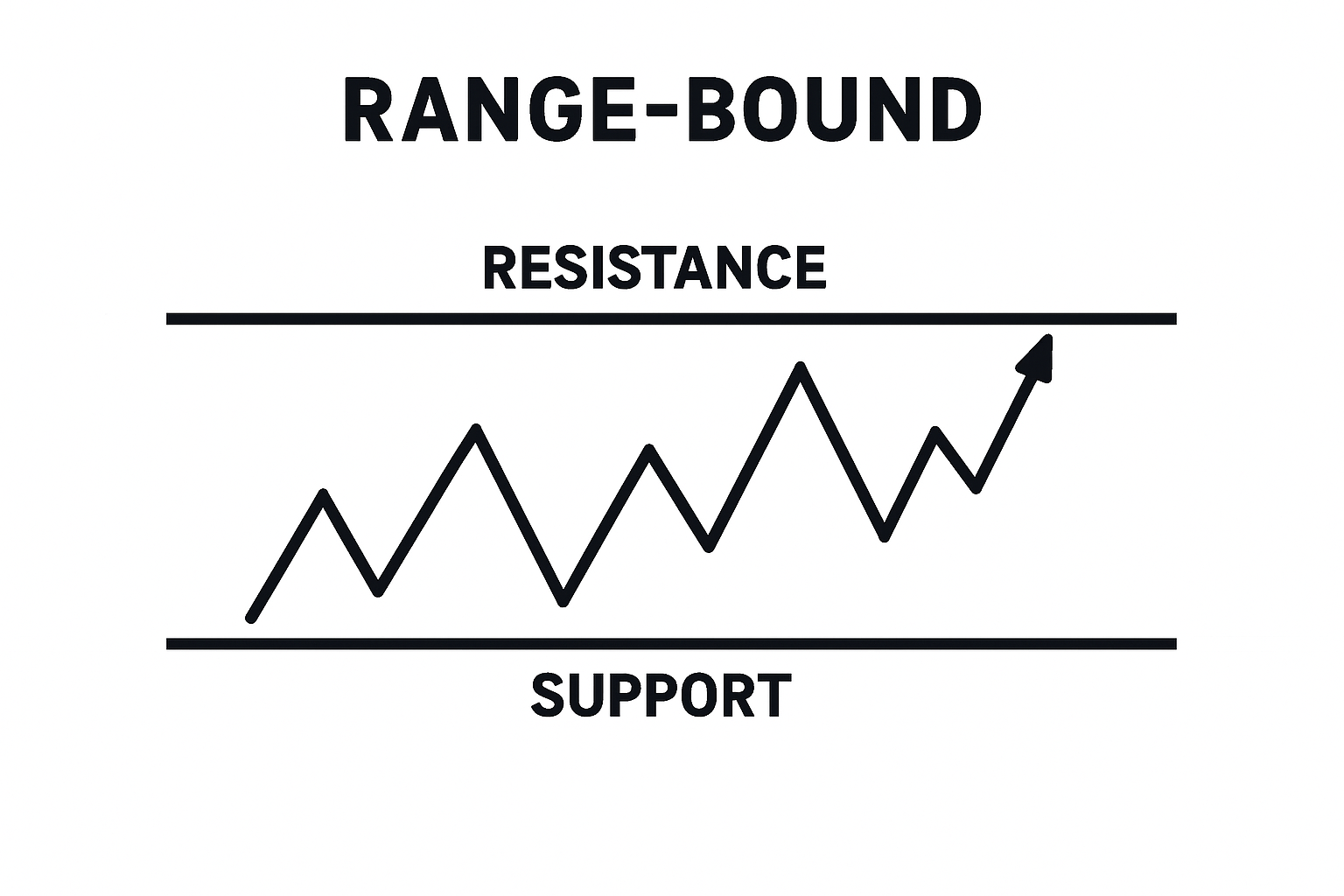

4. Range-Bound Scalping

- Trades in sideways markets within support and resistance.

- Example: Stock moves between ₹1,000 (support) and ₹1,020 (resistance). Buy near ₹1,000, sell near ₹1,020 repeatedly.

- Requires patience and observation.

5. Indicator-Based Scalping

- Uses tools like RSI, MACD, and Stochastic Oscillator.

- Example: Buy when RSI is oversold (<30) on a 1-minute chart; sell when RSI >70.

- Provides beginners with clear entry and exit signals.

Step-by-Step Example of a Scalping Trade

Let’s go through a live trade setup for clarity:

- Asset Selection: Nifty 50 index

- Timeframe: 5-minute chart

- Indicator: RSI + 5-EMA / 20-EMA crossover

- Entry Rule: Buy when RSI <30 and 5-EMA crosses above 20-EMA

- Exit Rule: Sell when RSI >70 or when 5-EMA crosses below 20-EMA

- Stop-Loss: 0.2–0.5% below entry price

- Target Profit: 0.5–1% gain per trade

Result: In a 1-hour session, a trader could execute 5–8 such trades, accumulating 2–5% profit on their trading capital.

Mini Case Study: Beginner Success Story

Rohit, a beginner, joined a share market online class focused on scalping.

- Week 1: Learned chart patterns and basic RSI setups.

- Week 2: Practiced 10 demo trades per day.

- Week 3: Executed live trades with ₹25,000 capital.

- Outcome: Rohit made consistent small profits daily and avoided common mistakes like overtrading or ignoring stop-losses.

This shows the impact of structured learning and practice for beginners.

Expert Strategies to Make Scalping Simple

Use a Share Market Online Class

Classes offer step-by-step training, live sessions, and expert guidance. Beginners learn best scalping strategy, simple scalping techniques, and expert scalping methods in a structured environment.

Stick to the Right Timeframes

1-minute, 5-minute, and 15-minute charts are ideal. Avoid sub-minute charts—they are too noisy.

Set Entry and Exit Rules

Define stop-loss and target profit for each trade. Discipline prevents emotional mistakes.

Trade Liquid Markets

Focus on high-volume stocks, forex pairs, or commodities for fast execution and minimal slippage.

Use Low-Cost Brokers

High commissions destroy small profits. Use platforms like Zerodha Kite, Thinkorswim, and Interactive Brokers.

Practice Risk Management

Never risk more than 1–2% per trade. Small risks protect capital during losing streaks.

Control Emotions

Avoid revenge trading, take breaks, and maintain focus for consistent results.

Simple Scalping Techniques for Beginners

- Trade one asset at a time

- Follow a daily routine and trade checklist

- Limit indicators to avoid confusion

- Practice with demo accounts

- Keep a trading journal to track mistakes and successes

Common Mistakes in Scalping Trading

- Overtrading without a strategy

- Ignoring transaction costs

- Using too many indicators

- Trading illiquid assets

- Holding losses hoping for a reversal

- Click here to know more

Tools That Simplify Scalping Trading

- Trading Platforms: Zerodha Kite, Thinkorswim, Interactive Brokers

- Charting Tools: TradingView, MetaTrader 4/5

- News Sources: Bloomberg, Reuters, Economic Calendars

- Risk Calculators: For position sizing and managing losses

Risks and Rewards of Scalping

Rewards:

- Quick profits

- Multiple daily opportunities

- Exciting, fast-paced trading environment

Risks:

- High stress and mental fatigue

- Small mistakes multiply quickly

- High transaction costs

- Requires strict discipline and patience

Supporting Paragraphs: Share Market Online Class

Why a Share Market Online Class Is Essential for Beginners

A share market online class provides structured learning for beginners who want to understand scalping trading strategies effectively. Unlike trial-and-error methods, these classes offer step-by-step guidance on technical analysis, chart reading, and risk management. By attending a share market online class, beginners gain access to expert scalping methods, live market examples, and practical exercises that help them build confidence before trading with real money.

Boost Your Scalping Skills with Expert-Led Share Market Online Classes

Expert-led share market online classes simplify complex trading strategies into actionable steps. Classes often cover best scalping strategy, simple scalping techniques, and managing multiple trades in high-pressure markets. Students also learn to use trading platforms, apply indicators like RSI or MACD, and execute trades efficiently. These classes equip beginners with the skills and discipline needed to succeed in scalping trading, making the learning curve much smoother.

FAQs

What is scalping trading for beginners?

Short-term strategy to make small profits using expert methods and risk management.

Can I learn scalping online?

Yes, share market online classes teach strategies, live examples, and risk management for beginners.

How much money do I need to start scalping?

₹25,000–₹50,000 for stocks, $500–$1000 for forex, depending on the market.

Which timeframe is best for scalping trading strategies?

1-minute, 5-minute, or 15-minute charts are ideal.

Is scalping profitable long term?

Yes, with strict rules, disciplined trading, and risk management.

What is the difference between scalping and day trading?

Scalping: many short trades for tiny profits.

Day trading: fewer trades held hours within the same day.

What is the best scalping strategy for beginners?

Price action, moving average crossovers, and indicator-based strategies like RSI or MACD.

How many trades should a beginner take in scalping?

Start with 5–10 trades per day to build experience safely.

Can scalping be automated with bots?

Yes, but beginners should learn manual trading first.

Which markets are best for scalping trading?

High-volume stocks, forex pairs, commodities, and liquid cryptocurrencies.

How do experts manage risk in scalping?

Stop-loss orders, small risk per trade, and avoiding overtrading.

How long does it take to learn scalping trading for beginners?

1–2 months to grasp basics; 6–12 months for mastery.

What indicators are commonly used in scalping trading strategies?

RSI, MACD, Stochastic Oscillator, Bollinger Bands, and moving averages.

How do I avoid losses in scalping trading?

Set stop-losses, limit risk, trade liquid assets, and control emotions.

Can scalping be done in stocks, forex, and crypto?

Yes, all liquid markets are suitable if proper strategies are applied.

What is range-bound scalping?

Using sudden price spikes caused by news or events to make quick profits.

What is momentum scalping?

Using sudden price spikes caused by news or events to make quick profits.

What is price action scalping?

Trading based on candlestick patterns and market movement without heavy indicators.

Are share market online classes enough to become a scalper?

They provide a foundation, but practical experience and disciplined practice are necessary.

How do moving averages help in scalping?

They identify short-term trends and provide clear buy/sell signals for quick trades.