Are you looking for Cross-border commodity finance models are structured ways of lending money across countries by using raw materials like oil, metals, or crops as collateral—helping exporters and traders get funds before buyers pay. These models reduce risk for lenders, speed up global trade, and give businesses access to working capital while goods are still in transit. By mastering these finance models, traders can better understand how international deals are funded, how risks are managed, and how structured finance supports over 80% of world trade.

Cross-border commodity finance models

What is Cross-Border Commodity Finance?

Cross-border commodity finance models bridges borders in international trade. Picture a coffee farmer in Brazil who needs money today to pack and ship beans to Europe—but payment only comes later. A bank steps in, lends money, and holds the beans as collateral. When the buyer pays, the loan is cleared. This seamless process drives about 80–90% of global trade, confirms the WTO.

Why Commodity Finance Matters for Traders

If you’re into trading, this is key. Commodity finance fuels the engine of global trade. It ensures:

- Exporters get cash when they need it.

- Buyers get reliable deliveries.

- Lenders stay safe through collateral.

- Markets remain liquid, even for big items like wheat, oil, and copper.

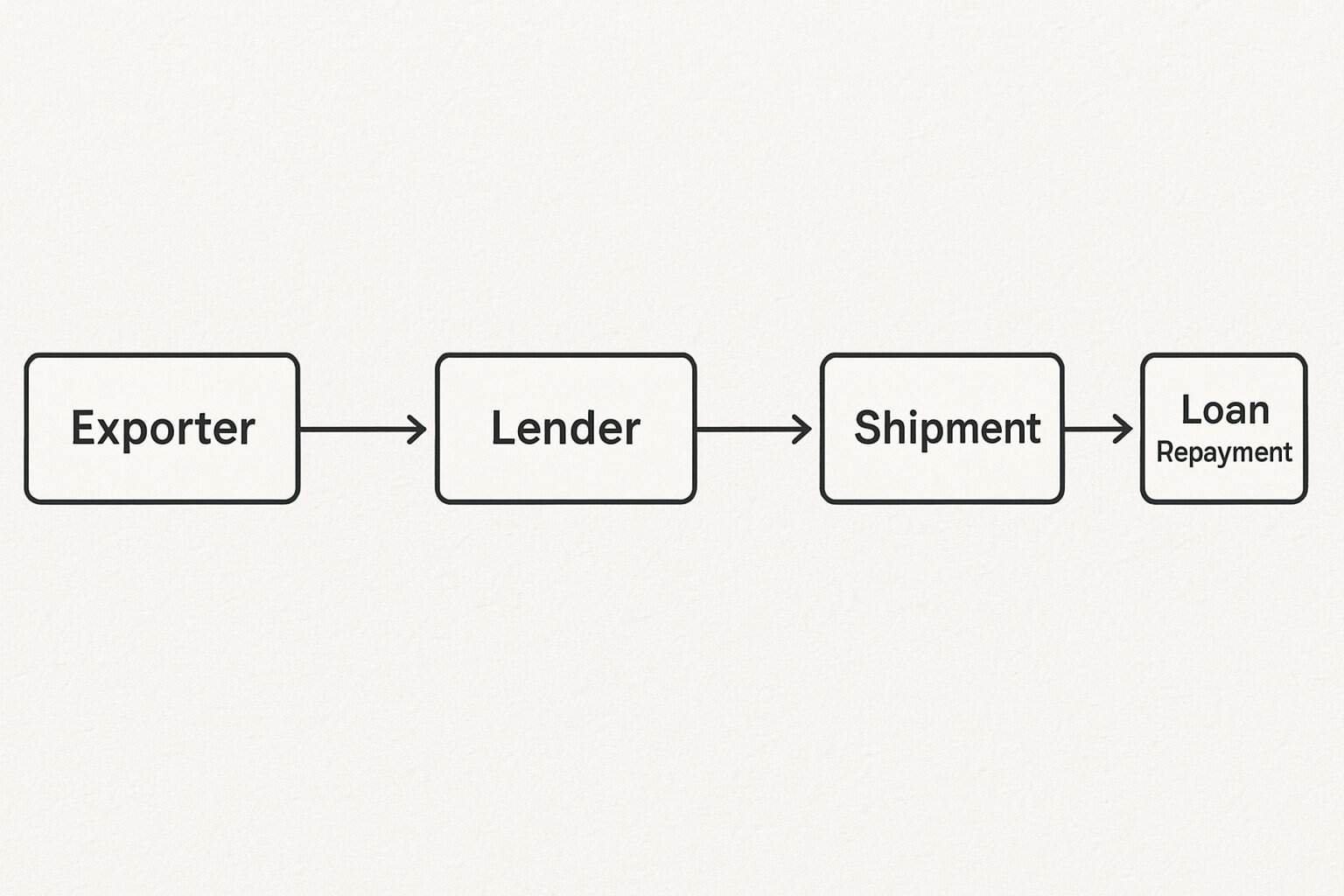

How Commodity-Backed Finance Works

- Exporter needs money before goods are sold.

- Lender gives a loan using commodity (like grains or oil) as security.

- Exporter ships goods.

- Buyer pays later.

- Exporter repays the loan.

Key Models in Cross-Border Commodity Finance

1. Pre-Export Finance (PXF)

Loan given before goods ship; repaid after buyer pays—common for agriculture.

2. Borrowing Base Facilities

Loan value depends on stored goods’ value; adjusts as prices change.

3. Offtake Agreements

Future purchase deals (e.g. a buyer commits to purchasing steel) secure lending.

4. Tolling Finance

Raw materials sent to refineries; processed goods used as loan collateral.

Benefits of Cross-Border Commodity Finance

- Fast access to cash

- Lower risk for lenders

- Reliable global supply

- Boosts business growth

Risks in Cross-Border Finance

- Price swings (e.g., oil price crashes)

- Political instability (like sanctions or conflicts)

- Fraud (fake warehouse receipts)

- Legal issues across countries

Global Trade & Finance Statistics (2024–2025)

- Global trade reached a record $33 trillion in 2024, with goods contributing $500 billion in growth and developing economies leading the gains. UN Trade and Development (UNCTAD)

- Meanwhile, trade finance sees growing demand: in 2024, over 91 million trade finance transactions were recorded globally (up 9% from the year before), with digital platforms slashing processing times to under 7 days. Market Growth Reports

These numbers show how essential and dynamic structured finance is in trade today.

Technology & the Future of Commodity Finance

Digital tools are changing the game:

- Blockchain slashes fraud risk.

- AI improves risk insights and pricing.

- Smart contracts and digital receipts speed processes.

Education: Structured Finance Meets Real Learning

Learn Commodity Finance through the Best Trading Course in Chennai

If you’re serious about understanding global trade and its finance backbone, the best trading course in Chennai offers hands-on exposure to pre-export finance, risk management, and structured trade models. It’s one thing to read about it—it’s another to see how deals are made, priced, and financed.

Why Chennai is a Learning Hub for Finance

Chennai blends financial firms, export-import activity, and teaching academies into a nurturing space for learners. The best trading course in Chennai connects you to real-world examples, case studies, and networks that help you master commodities, structured finance, and cross-border trading.

20 FAQs on Cross-Border Commodity Finance

How does cross-border commodity finance work?

Traders use goods like oil, metals, or crops as collateral to get loans that fund export deals across countries.

Why is cross-border commodity finance so important?

Because most global trade relies on it. Without it, exporters often can’t afford to ship before payment arrives.

What are common commodities used for finance?

Oil, grains (wheat, rice), coffee, metals (gold, copper), and energy commodities are widely used.

What exactly is pre-export finance (PXF)?

A loan given before shipping goods, repaid when the buyer eventually pays.

How do borrowing base facilities protect lenders?

They tie loan size to the value of stored goods, cutting exposure if prices drop.

Why are offtake agreements valuable?

They guarantee buyers for goods in advance, giving lenders confidence.

How does tolling finance function?

Raw materials are processed for lenders, who finance the operation, using finished goods as security

What benefits do traders gain from commodity finance?

Fast cash, less risk, stable trade supply, and growth opportunities

What risks are involved?

Market volatility, geopolitical threats, fraud, and cross-border legal challenges.

How big is global trade today?

In 2024, global trade hit $33 trillion, showing how vital structured finance is.

How fast is trade finance growing?

In 2024, there were 91 million trade finance transactions—a 9% rise—with digital platforms cutting loan processing to under 7 days

How do small exporters benefit?

Loans backed by their crops or materials help them grow without waiting months for payment

What if a borrower defaults?

Lenders sell the collateral—like stored grain or oil—to recover the loan

Can digital tools reduce fraud?

Absolutely. Blockchain and smart contracts make tampering nearly impossible.

How does ESG affect trade finance?

More lenders now support green trades, like renewable metals or sustainable agriculture.

How does AI support this finance?

It predicts commodity price risks and evaluates borrower reliability faster and more accurately.

What role do governments play?

Export credit agencies back exporters with guarantees to reduce lender risk.

Is commodity finance only for big exporters?

No, small exporters and farmers also rely on it heavily.

Where can one learn these models properly?

Look for real-world training—for example, the best trading course in Chennai offers structured finance with practical insights

Why is technology named trade finance’s future?

Digital systems speed approvals, blockchain prevents fraud, and AI sharpens risk decisions.

Conclusion

Cross-border commodity finance is the hidden engine behind global trade. It enables sellers to get funded, buyers to receive goods, and trade to keep flowing—all backed by tangible commodities. With modern innovations and increasing demand (like a $33 trillion trade flow and 91 million finance trades in 2024 alone), this field is more relevant than ever.

By mastering these models and supplementing that with quality training—such as the best trading course in Chennai—you position yourself at the forefront of trade finance and global commerce.

Want to stay ahead in global trade and finance? Reach out to us — we’re here to guide you every step of the way