How to make Career in Stock Market in India?

Stock Market and Trading gives a wide range of opportunities to gain knowledge of the financial market. This is one of the highest-earning professions in the world. Choosing stock market as a career will require more knowledge and experience in the financial market.

If you want to make a career in the stock market, you need to have certain qualifications. These qualifications include knowledge of the stock market, an understanding of economics, and an understanding of financial analysis. You also have critical thinking to take risks and can make decisions quickly.

After your successful completion of your degree, You don’t have proper guidance to start your career in the stock market field. But you are interested in stock market trading and want to gain experience and knowledge in the stock market. You don’t know where to start?

Here is the solution, To get a job in a stock market related field you have to complete the NISM Certificate Examination.

Table of Contents

National Institute of Securities Markets

The National Institute of Securities Markets (NISM) is an educational and regulatory initiative established by the Securities and Exchange Board of India (SEBI) in 2006. NISM aims to enhance the quality of the securities markets in India by imparting knowledge and skills to market participants and professionals.

NISM offers a variety of programs, including certifications, training courses, and academic programs, designed to cater to the needs of different segments of the financial markets. These programs cover various aspects of the securities markets, including securities operations, compliance, mutual funds, research analysis, and financial planning.

Below are list of NISM Certificate Examinations that describe the details of the exam like Exam Name, Fees, No. of Questions, Duration, Pass %, Negative mark, and Certificate validity.

List of NISM Certificate Examinations

Let’s see in detail about NISM Certificates and its sector and what they are used for.

Derivatives

NISM Series I: Currency Derivatives

This NISM certificate is for the profession who want to work in the Currency Derivatives segment in broking or investment related companies. If you complete this certificate you will gain the basic knowledge and better understanding of currency markets and exchange-traded currency futures products, better quality investor service, operational process efficiency and risk controls.

To Know more, Click Here…

NISM Series XVI: Commodity Derivatives Certification Examination

This NISM certificate is for the profession who want to work in the Commodity Derivatives segment in broking or investment related companies. If you complete this certificate you will gain a better understanding of various derivatives products available in commodity derivatives markets, regulations and risks associated with the products and the exchange mechanisms of trading, clearing and settlement.

To know more, Click Here…

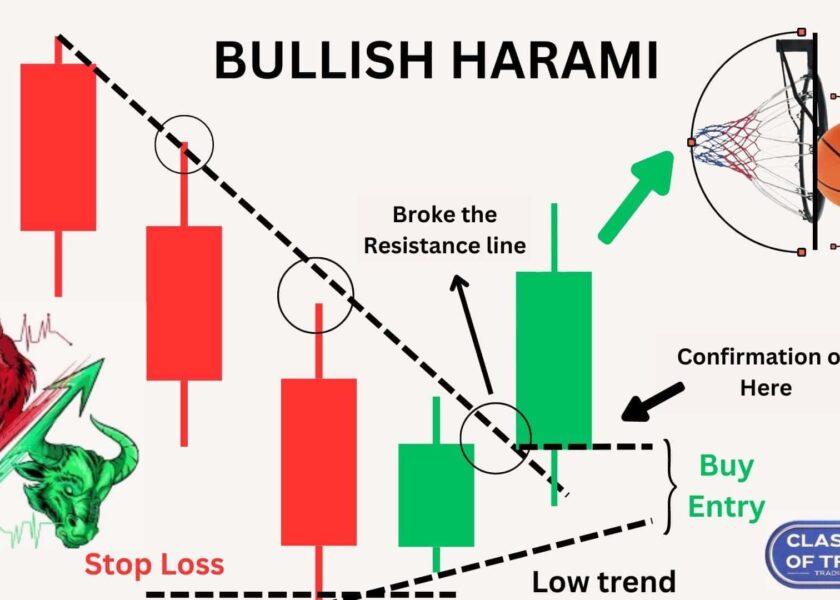

NISM Series VIII: Equity Derivatives

This NISM certificate is for the profession who want to work in the Stocks or Equity Derivatives segment in broking or investment related companies. This Certificate will help develop a career as a technical analyst, Equity Dealer, derivatives trader, or prop-desk job.

This certificate gives a wide range of basic knowledge in Future and Option equity derivatives, Understand the various trading strategies that is used in futures and options on both stocks and stock indices. It also gives a better understanding of various derivatives products available in equity derivatives markets, regulations and risks associated with the products and the exchange mechanisms of clearing and settlement.

To know more, Click Here…

NISM Series IV: Interest Rate Derivatives

This NISM certificate is for the profession who want to work in the stock market dealing with fixed-income securities and interest rate derivatives. This certificate gives a better understanding of fixed-income securities markets and interest rate derivative products, Bond Futures market along with trading and hedging strategies, regulations and risks, and the exchange mechanisms of clearing and settlement.

To know more, Click Here…

NISM Series XIII: Common Derivatives Certification Examination

This NISM certificate is for the profession who want to know and work in the derivative segment of the Indian Stock Market. This certificate gives a better understanding of the basics of the Indian derivatives market (covering Equity Derivatives, Currency Derivatives and Interest Rate Derivatives). Understand the various trading and hedging strategies that used in futures and options. Understand the clearing, settlement and risk management as well as the operational mechanism related to the derivatives markets.

To know more, Click Here…

Registrar & Transfer Agents

NISM Series II A: RTA – Corporate

This NISM certificate is for the profession who want an RTA (Registrars and Transfer

Agents) Issue and Share Transfer Agents for Corporate as a business or work with an RTA firm. This certificate gives the basics of securities and securities markets. Understand broadly the role and functions of the RTAs in the corporate securities issuance and transfer process. And to know the regulatory environment in which the RTAs operate in India.

To know more, Click Here…

NISM Series II B: RTA – Mutual Fund

This NISM certificate is for the profession who want an RTA (Registrars and Transfer Agents) Issue and Share Transfer Agents for mutual fund as a business or work with an RTA firm. This certificate gives the basics knowledge in securities and securities markets. Understand broadly the role and functions of the RTAs in the mutual fund issuance and transaction process. And to know the regulatory environment in which the RTAs operate in India.

To know more, Click Here…

Compliance

NISM Series III A: Securities Intermediaries Compliance (Non-Fund)

This NISM certificate is for the profession who want to work in compliance function with any intermediary registered as Stock, Depository, Sub-brokers, Participants, Merchant Bankers, Underwriters, Bankers to the Issue, Debenture Trustees and Credit Rating Agencies. In this certificate you will learn about the structure of financial and securities markets, financial intermediaries, Understand the Importance of Compliance function and the scope and role of the compliance officer in the Indian securities market, and other importance of compliance of the rules and regulations and the penal actions.

To know more, Click Here…

Mutual Fund

NISM Series V A: Mutual Fund Distributors

This NISM certificate is for the profession who want to work in mutual fund industry as an sales agent or distributor. In this certificate you will know about the basics of mutual funds, role and structure, different kinds of mutual fund schemes and their features.

To know more, Click Here…

NISM Series V B: Mutual Fund Foundation

This NISM certificate is for the profession who want to work in mutual fund industry as an sales agent or distributor. This certification aims to enhance the quality of sales, distribution and related support services in the mutual fund industry.

To know more, Click Here…

Operations

NISM Series VI: Depository Operations

This NISM certificate is for the profession who want to work or employed by a registered depository participant in dealing or interacting with clients, dealing with securities of clients, handling remedy of investor grievances, internal control or risk management, bearing on operational risk, or maintenance of books and records pertaining to the above activities.

To know more, Click Here…

NISM Series VII: Securities Operations and Risk Management

This NISM certificate is for the profession who want to work in the requisite standard for associated persons of a registered stock-broker / trading member / clearing member in recognized stock exchanges, involved in (a) assets or funds of investor or clients (b) redressal of investor grievances, (c) internal control or risk management and (d) activities having a bearing on operational risk.

To know more, Click Here…

Merchant Banking

NISM Series IX: Merchant Banking

This NISM certificate is for the profession who want to work in the merchant banking sector, open offers, launch IPOs, and buybacks of shares. This certificate give a better understanding of various regulations in the Merchant Banking Domain.

To know more, Click Here…

Investment Adviser

NISM Series X A: Investment Adviser (Level 1)

This NISM certificate is for the profession who want to become an register Investment Adviser for financial planning. An investment adviser are required to pass both the levels (i.e. NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination and NISM-Series-X-B: Investment Adviser (Level 2) Certification Examination to get has an SEBI registered Investment Adviser.

In this certificate you will get know the basics of personal financial planning, time value of money, evaluating the financial position of clients, debt management and loans., know about portfolio construction, performance monitoring and evaluation.

To know more, Click Here…

NISM Series X B: Investment Advisors (Level 2)

This NISM certificate is for the profession who want to become an register Investment Adviser for financial planning. This certificate is the Level 2 certificate of Investment Advisors. It is necessary to complete both level to get registered as Investment Advisors.

In this certificate you will get know about insurance planning, insurance products and risk management. Understand the various retirement products and their features. The taxation aspects of different financial securities.

To know more, Click Here…

Basics of Securities Markets

NISM Series XII: Securities Markets Foundation

This NISM certificate is for entry-level professionals, who wish to make a career in the securities markets. In this certificate you will get to know about the basics of the Indian Securities Markets, products in Mutual Funds and Derivatives Markets, Primary and Secondary Markets, Financial planning.

To know more, Click Here…

Research Analyst

NISM Series XV: Research Analyst Certification Examination

This NISM certificate is for the profession who want to work as Research Analyst in financial sector, Broking firms, or Investment sector. In this certificate you will get to know about the basics of Indian Securities Markets and terminologies, fundamental research, micro and macro-economic analysis, industry analysis, Qualitative and Quantitative of Company Analysis, Fundamentals of Risk and Return, Valuation Principles, and the philosophy of various Corporate Actions.

To know more, Click Here…

Retirement Adviser

NISM Series XVII: Retirement Adviser Certification Examination

This NISM certificate is for the profession who want to become retirement planning and advisory

services. In this certificate you will get to know about the concepts in Retirement Planning and the various investment products, the features and benefits of National Pension System, the strategies useful to investors in executing their retirement plan.

To know more, Click Here…

Alternative Investment Funds (AIF)

NISM Series XIX-A: Alternative Investment Funds (Category I and II) Distributors

This NISM certificate is for the profession who want to work as Distributors or Placement Agents in Alternative Investment Fund domain for sales and distribution services. This examination focuses on Category I and Category II AIFs. In this certificate you will get to now about structure, risk-return relationship, investment process, governance aspects, monitoring and exit strategies of AIFs.

To know more, Click Here…

NISM Series XIX-B: Alternative Investment Funds (Category III) Distributors

This NISM certificate is for the profession who want to work as Distributors or Placement Agents in Alternative Investment Fund domain for sales and distribution services. This examination focuses on Category III AIFs. In this certificate you will get to know about Ecosystem of AIF (Category III), Fund structure, fee structure, performance measurement techniques and its interpretations, importance and role of performance benchmarking, Various investment strategies, Concept of NAV and valuation techniques.

To know more, Click Here…

NISM Series XIX-C: Alternative Investment Fund Managers

This NISM certificate is for the profession who want to work as AIF Manager position. In this certificate you will get to know about a better understanding of features of AIF products, AIF Manager roles and responsibilities, investment valuation norms, fund governance processes, fund performance measurements, taxation aspects and related regulations.

To know more, Click Here…

Portfolio Management Services

NISM Series XXI-A: Portfolio Management Services (PMS) Distributors Certification Examination

This NISM certificate is for the profession who want to work as Portfolio Management Services Distributors in an investment company. In this certificate you will get to know about the basics of investments, securities markets, investing in stocks, understanding fixed income securities, derivatives and mutual funds, Understand the role of portfolio managers, operational aspects of portfolio management services and about the portfolio management process, performance measurement and evaluation of portfolio managers.

To know more, Click Here…

NISM-Series-XXI-B: Portfolio Managers Certification Examination

This NISM certificate is for the profession who want to work as principal officers and other employees of the Portfolio Management Services (PMS) firms. In this certificate you will get to know about the basics of investments, securities markets, investing in stocks, understanding fixed income securities, derivatives and mutual funds, about indices, concept of information efficiency, behavioural finance, modern portfolio theory, equity and fixed income portfolio management strategies.

To know more, Click Here…

Fixed Income Securities

NISM-Series-XXII: Fixed Income Securities Certification Examination

This NISM certificate is for the profession who want to work in Fixed Income Securities markets. In this certificate you will get to know about the basics of Indian debt markets and different terminologies used in debt markets, know the pricing of bonds (including floating rate bond), price-yield relationship and price time path of a bond, Understand the term structure of interest rates and the relationship between spot and forward rates.

To know more, Click Here…

Conclusion

In an overview, this NISM certificate is the entry-level for your career to get started. You can crack the exam by studying the resources provided by NISM and taking mock tests. After completion of the exam, you will get the certificate within 15 days after your exam. These certificate is just entry-level for your career. You need more knowledge and experience to become an expert in this stock market field. So try to learn more about the stock market, take a course on the stock market to get practical knowledge and training.

To learn Stock Market Course, Click Here…

To get the Study Material for NISM Certificate Examination, Click Here…

To register for NISM Certificate Examination, Click Here…

This blog will be helpful for those who are want to make their career in the stock market field.

This blog also helps to understand the types of NISM exams and how it will make a career in the stock market field.