The Japanese Candlestick Charting Techniques – by Steve Nison

Introduction

The Japanese Candlestick Charting Techniques Second Edition book was written by Steve Nison. The Japanese Candlestick Charting Techniques Second Edition book has a total of 17 chapters and is divided into 2 parts, part 1 contains the 3-9 chapters and part 2 contains the balance 10-17chapters.

Table of Contents

Overview of the book

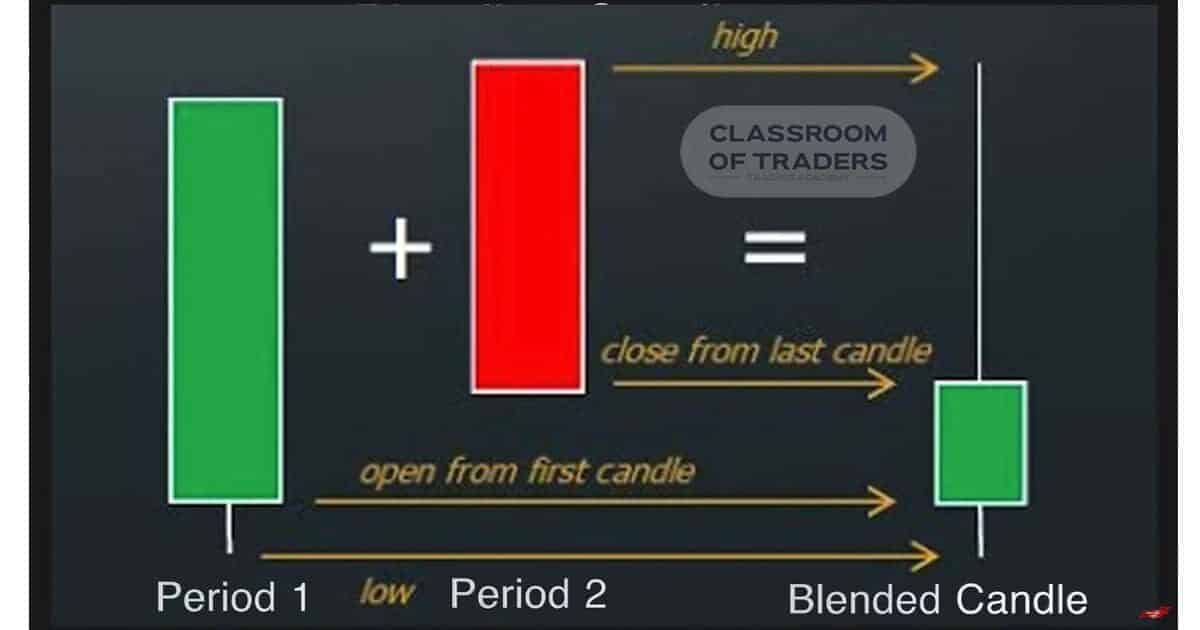

Steve Nison structures the book from basics to advanced strategies. The second edition of the book aims to make candlestick charting more accessible and practical for modern traders. While the format and underlying concept are the same as in the first edition. This Second Edition book contains:

- More about intraday markets

- More focus on active trading for swing, and day traders

- New tactics for getting maximum use from intraday charts

- New Western techniques in combination with candles

- A greater focus on capital preservation.

Benefits of the Books

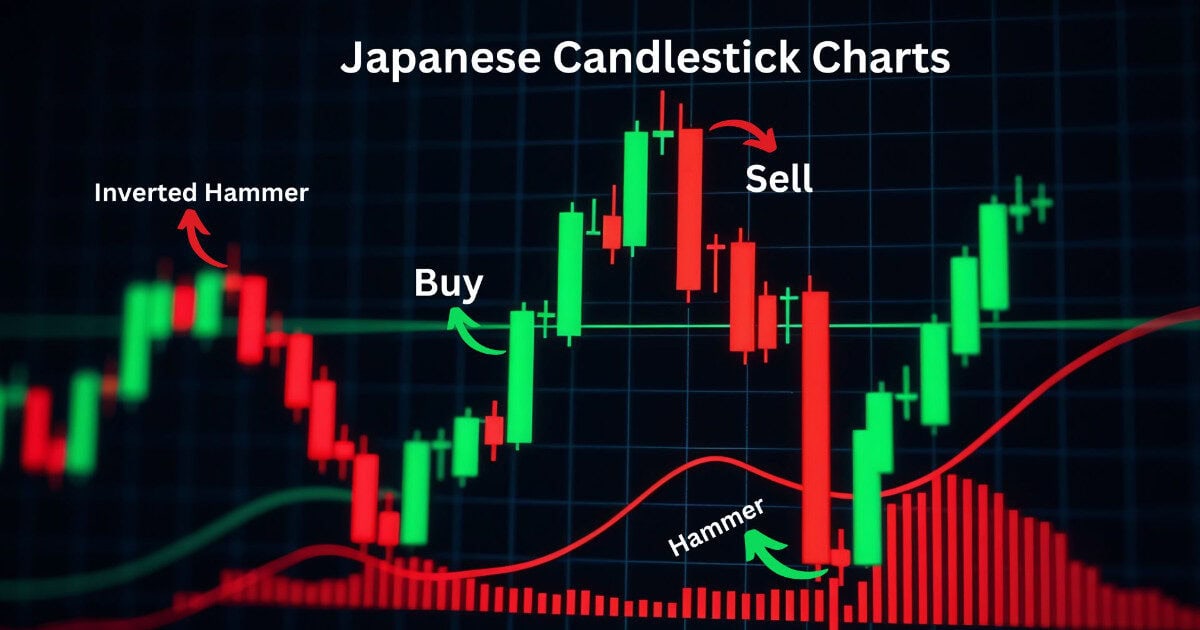

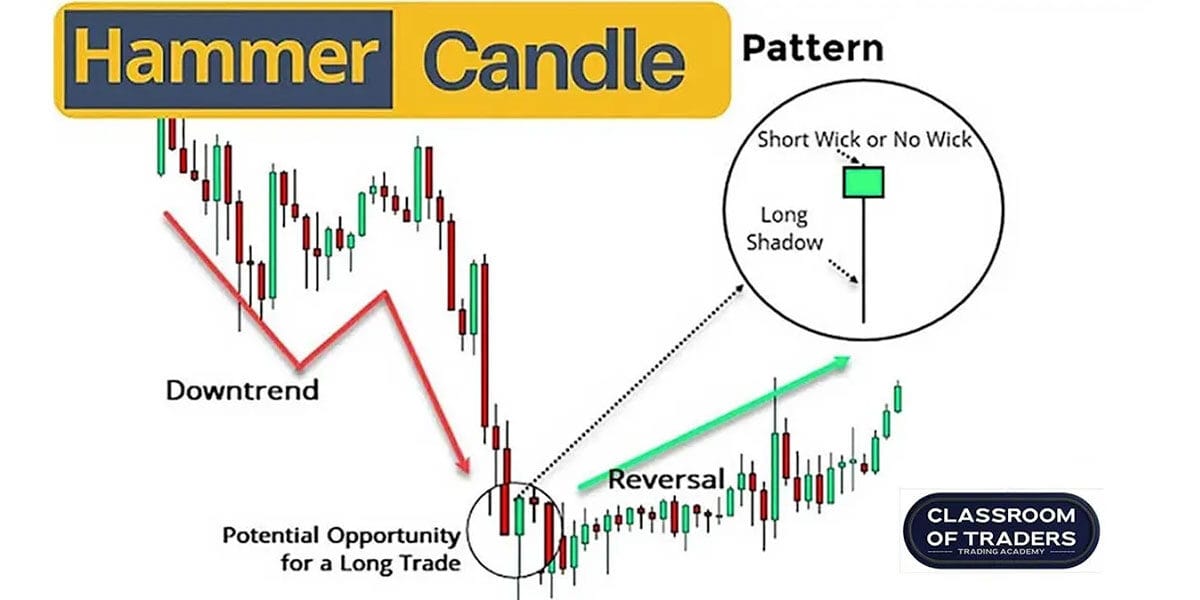

A number of benefits can be gained from Japanese candlestick Charting, including enhanced understanding of the market, practical strategies, improved risk management, and accessibility to traders of all levels.

When you are reading this book you get guidance from experts and educational resources that

help traders and investors become more effective traders with candlestick patterns.

Reviews and Recommendation

The Japanese Candlestick Charting Techniques, Second Edition book was helpful to traders, who are seeking a master to learn Candlestick Charting.

Steve Nison gives a clear explanation and improved visuals that make complex concepts more digestible. Most people said that the book’s focus, particularly on multiple real-world examples and case studies, shows how candlestick patterns can be used to inform trading decisions, and this book is more effective for both beginner and experienced traders.

About Author

Steve Nison completed his M.B.A. in Finance and Investment. He, Chartered Market Technician (CMT), is the founder and President of Candlecharts.com which provides premier educational products and trading services and he worked in the early periods of the 1990s. He writes books about the Japanese Candlestick Charting Techniques, Beyond Candlestick Charting, Japanese Candlestick Charting Techniques, Second Edition, and The Candlestick Course. His two books, Japanese Candlestick Charting Techniques and Beyond Candlestick are international best sellers and the foundation of all candlestick research and analysis.

Conclusion

Steve Nison’s Japanese Candlestick Charting Techniques, Second Edition book definitely gives a guide for anyone looking for a master to learn Candlestick Charting. The book provides in-depth information on various candlesticks from basics to advanced patterns. The book is an essential addition to any trader’s library.

To learn all the 298 pages