How to Make Consistent Profit in Trading?

Trading is where people buy and sell things like stocks, currencies, and commodities, hoping to make money. Imagine it as a roller coaster ride with ups and downs. Trading is not just about luck it’s about learning, strategising, and risk management.

An Overview Of How To Make Money In Trading

In this blog, we’re going to see how we can make 100% profit in trading with our Money Management Techniques. What are the steps needed to make consistent profit with discipline and confidence in trading. So, buckle up as we explore the ins and outs of money management in trading, in simple words that anyone can understand. Let’s get started!

Steps needed to make Consistent Profit

Risk Management Strategies:

Risk management involves strategies and techniques used by traders to minimize potential losses and preserve capital. This includes techniques such as position sizing, stop-loss orders, and diversification.

Position Sizing:

This refers to determining the amount of capital to invest in a particular trade based on factors such as the trader’s risk tolerance, account size of the trade.

Stop Loss Orders:

Traders use stop-loss orders to automatically sell a security when it reaches a certain price, limiting potential losses on a trade. Stop-loss orders help traders manage risk by setting predefined exit points.

Diversification:

In trading, diversification involves spreading capital across different assets or securities to reduce the impact of any single investment performing poorly. This can include diversifying across all segments to minimize the loss and preserve the capital.

Risk-to-Reward Ratio For Day Trading:

This ratio is particularly important in trading. It measures the potential profit of a trade relative to the potential loss. Traders often seek trades with a favorable risk-to-reward ratio for day trading, where the potential reward is higher than the potential risk.

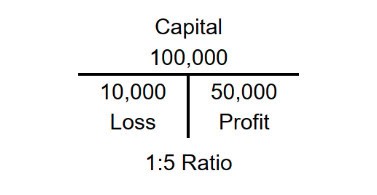

Importance of 1:5 Ratio:

Taking the 1:5 ratio minimizes the risk of losing the capital more, and gaining 5 times the loss as profit. If we lose 3 trades (each loses 100) and win 1 trade (which is 500), we will have an overall profit of 200. So keep in mind the ratio should be higher so that it can cover the loss and make a profit too.

Emotional Discipline:

Trading requires emotional discipline to stick to a trading plan and strategy, even during times of segment volatility or uncertainty. Traders must control emotions such as fear and greed to avoid making impulsive decisions that can lead to losses. Emotional discipline also involves adhering to risk management principles and avoiding emotional trading based on fear or excitement.

Choose the best Instrument:

Choose the instrument which gives low spread value, less Volatility, High Liquidity so that you can easily make profit and it gives you lower cost.

Low spread:

Choosing a low spread instrument will lower the cost and can make more profit.

Volatility:

The more the volatile of an instrument will lead to more loss. So choose a less volatile instrument so that we can manage our losses and stick to our money management.

Liquidity:

Liquidity affects spread. More liquid instruments typically have lower spreads because there are more buyers and sellers in the market, narrowing the spread. Forex pairs like EUR/USD, USD/JPY, GBP/USD are usually highly liquid.

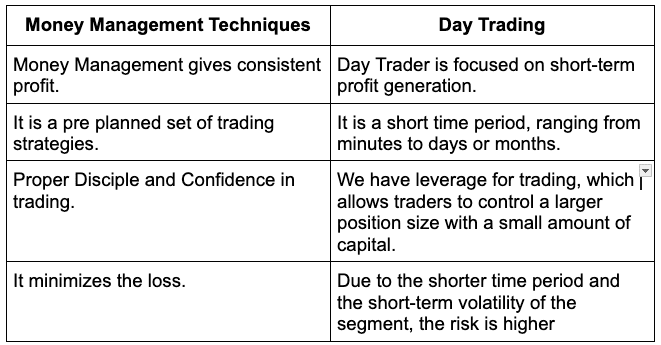

Money Management Techniques vs Day Trading (Speculation)

Strategy to make Consistent Profit in Trading

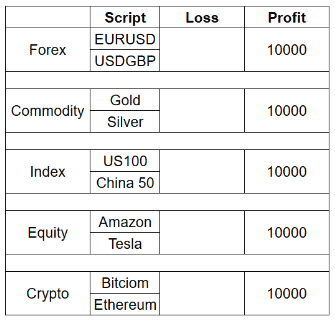

This strategy is about making profit of 50,000 with the capital of 100,000.

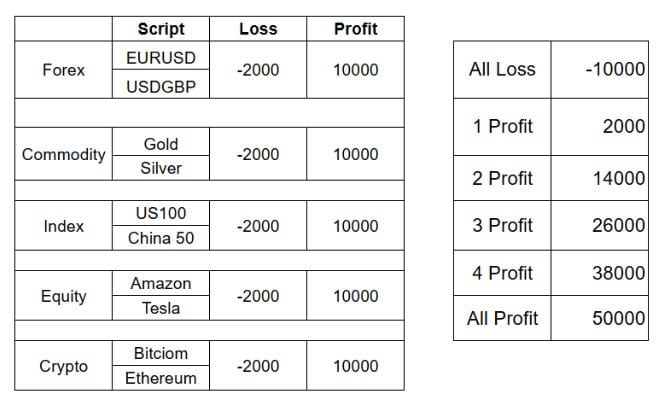

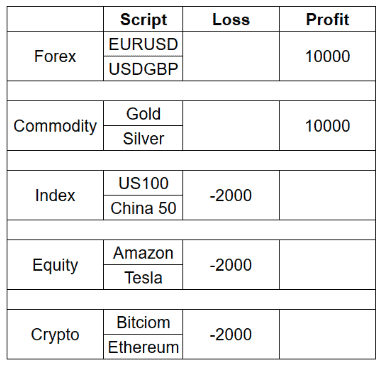

Starting with Forex we are gonna buy any 2 scripts like EUR/USD and USD/GBP and set an order of Stop loss 1000 for each script and Target of 5000 for each script. So the Stop Loss will be 2000 and the Target will be 10000 for Forex.

We are keeping Risk to Reward ratio in 1:5

Likewise we are gonna buy in different segments and minimum 2 scripts in each segment as shown in above image.

Now let see how the strategy works,

What will happen if all script are in loss

If all the scripts are in loss, we will be at a loss of 10000.

ie: 2000*5 = 10000

What happen If only 1 Segment is in Profit

If one segment is in profit and the remaining four segment in loss means we will be in profit of 2000.

ie: 10000 – (2000*4) => 10000 – 8000 = 2000

What happen If 2 Segments are in Profit

If two segment is in profit and the remaining three segment in loss means we will be in profit of 14000.

ie: (10000*2) – (2000*3) => 20000 – 6000 = 14000

What happen If 3 Segments are in Profit

If three segment is in profit and the remaining two segment in loss means we will be in profit of 26000

ie: (10000*3) – (2000*2) => 30000 – 4000 = 26000

What happen If 4 Segments are in Profit

If four segment is in profit and the remaining one segment in loss means we will be in profit of 38000

ie: (10000*4) – (2000) => 40000 – 2000 = 38000

If all the scripts are in profit, we will be at a profit of 50000.

ie: 10000*5 = 50000

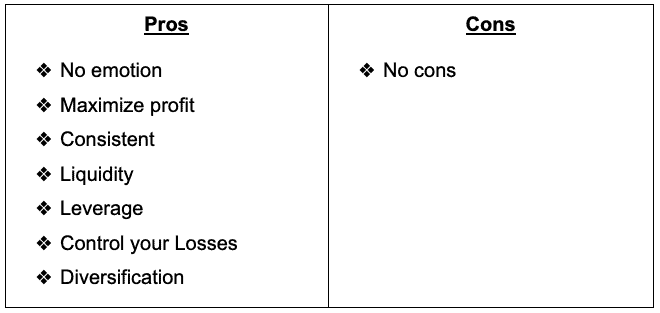

Pros and Cons of Money Management Techniques

Conclusion:

Either if we loss in all scripts, we will be losing 10000 and our capital will be 90000 or If we profit in all scripts, we will be in profit of 50000 and our capital will be 150,000. So the Ratio will be 1:5 in this case.

Not everytime we will be in loss, there will always be one profit in any of the segments. If we get 2 times All profit means our account will be doubled. And it will surely happen at least 5 times in a month.

So the overall conclusion will be, if we make the right Money Management Techniques with appropriate Risk to Reward ratios and with Disciple and Confidence, we will be surely making consistent profit in trading. Good Luck!

A Brief about Author

This Money Management Techniques is Discovered, Analysed, and Back tested by Fredrik. He is the Founder and the Mentor of Classroom Of Traders. He have 17 years of experience as Technical Analyst. He have worked for Angel One Ltd, Integrated Enterprises India Ltd, and Goodwill Research Team as a Technical Analyst.

❝Accept Small Losses and Wait for Huge Profit❞

Fredrik

FAQs

Can I trade with less capital?

Yes, you can trade with less capital in forex. It allows you to buy in low volume starting from 0.01 that needs low capital.

How to choose the instrument?

Choose the instrument which has Low spread value, Less Volatility, High Liquidity. Like the Major Currency pairs USD/GBP, EUR/USD.

Will I lose my Capital?

The maximum loss will be 10% of the capital ie,. in the above example 10000. So the loss is fixed, you won’t be loosing more than that.

Is 1:5 ratio possible?

If you are trading in Indian Market it is not at all possible, but in the International (Forex) market it is definitely possible because it has high volume and liquidity.

Best strategy i never seen

This strategy will be helpful to manage my capital and to make consistent profit in trading

Seriously

This money management strategy is working. This strategy is used to prevent my capital from loss while trading and now my account is in profit.

Thank you Classroom of Traders for sharing your strategies with us.