XM Forex Broker in India

XM Trading, also known as X-Markets, is an online forex and CFD broker initiated in Cyprus in 2009 by Constantino’s Cleanthous. The company headquartered in Cyprus and is regulated by the CySEC (Cyprus Securities and Exchange Commission). Originally it was a part of Trading Point of Financial Instruments Ltd, but it has increased in size to the largest and most established international investment. It is also highly regulated by tier 1 regulators. XM trades is most trusted trading online platform you can trade anywhere in world. Let see what are the services that XM broker provide in India.

Table of Contents

XM in India

XM provides access to the financial markets in over 1000 financial instruments including forex, equity indices, metals, and energies, with transparent real-time pricing, tight spreads and flexible leverage. The broker also offers a variety of account types to suit different traders, including Micro, Standard, and Ultra low accounts. XM Trading also offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and the XM WebTrader.

Key highlights of XM Trade in India

Regulations of XM in India

XM Global Limited, registered by the Financial Services Commission (FSC) under the Securities Industry Act 2021 (license number 000261/4) and Trading Point of Financial Instruments Limited, authorized and regulated by Cyprus Securities and Exchange Commission (CySEC) (licence number 120/10), are members of Trading Point Group.

XM Broker trading is not legal for residents of India. The RBI has issued guidelines to regulate foreign exchange transactions and prevent illegal activities such as money laundering and fraud. Indian traders who engage in XM Broker trading must ensure compliance with the following regulations:

- Know Your Customer (KYC): Traders are required to complete the KYC process by submitting documents such as proof of identity, address, and bank account details to verify their identity.

- Foreign Exchange Management Act (FEMA): Traders must abide by the FEMA regulations when investing in foreign exchange trading and adhere to the limits set by the RBI for overseas investments.

- Tax Reporting: Traders are obligated to report their foreign exchange earnings and pay taxes on the profits generated from XM Broker trading.

By following these regulations and guidelines, Indian traders can legally engage in XM Broker trading without facing any legal consequences.

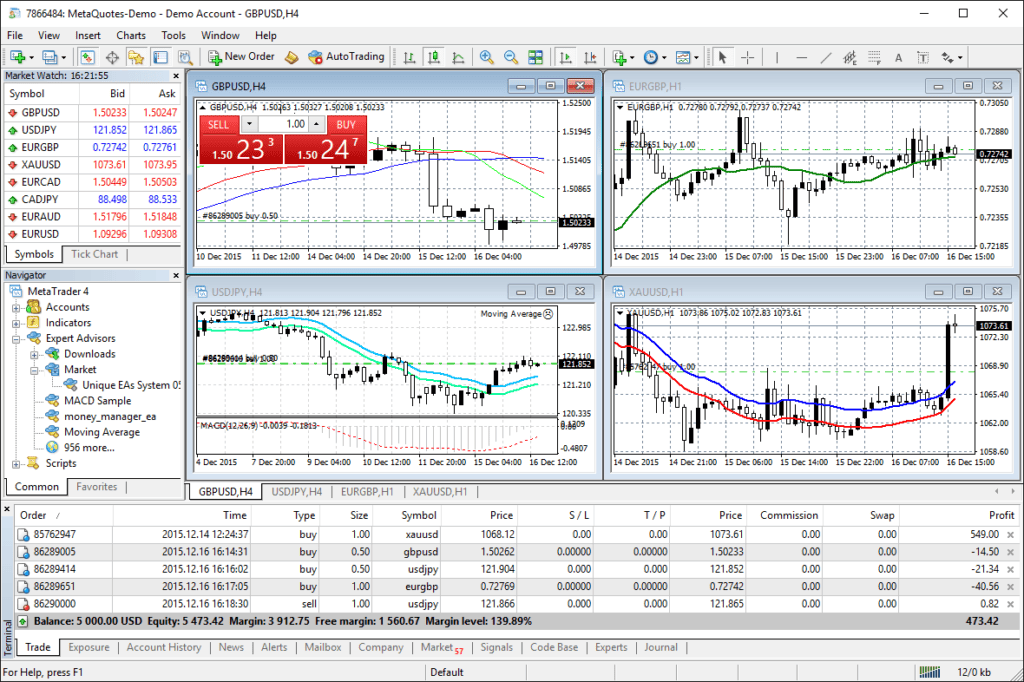

Trading Platforms

XM Broker offers state-of-the-art trading platforms with advanced tools and features to enhance the trading experience for users. From customizable charting tools to automated trading strategies and real-time market data, traders can make informed decisions and execute trades efficiently on the XM platform.

XM trades, is forex trade where the course specifically offers you the best in the foreign exchange markets that we avail you in this course in India, the foreign exchange markets mainly focus on the technical analysis and trading systems that offer to analysis and ensure that several platforms maintain a high-quality trade that benefits the traders in XM trades, that is

MT-4

MetaTrader 4 (MT4) is a widely-used electronic trading platform developed by MetaQuotes. MetaTrader 4 (MT4) is a popular trading platform offered by XM Forex Broker, one of the leading brokerage firms in the industry. XM provides a robust and user-friendly MT4 experience, catering to both novice and experienced traders. XM offers a wide range of trading instruments on MT4, including forex, commodities, indices, and cryptocurrencies. MetaTrader 4 with XM Forex Broker provides a comprehensive trading solution that combines advanced features, a user-friendly interface, and robust support services. MT4 is available in PC, Mac, Android and iPhone.

MT-5

MetaTrader 5 (MT5) is same as trading platform like MT 4. MT 5 is a advanced trading platform offered by XM Forex Broker, providing an enhanced trading experience compared to MetaTrader 4 (MT4). XM Forex Broker integrates MT5 to offer advanced trading features, comprehensive analysis tools, and a seamless trading environment. MetaTrader 5 with XM Forex Broker offers a powerful and advanced trading platform that enhances the trading experience. MT5 is available in PC, Mac, Android and iPhone.

Financial Trading Instruments

XM Global Limited, The forex broker exclusively offers in India provides a wide range of trading instruments, includes Forex, Commodities, Stocks, CFDs, and Cryptocurrencies, which trades over 1000 instruments.

Forex

Forex, or foreign exchange, is the global market for trading currencies. It is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. The forex market operates 24 hours a day, five days a week, allowing traders to buy, sell, exchange, and speculate on currencies.

Forex trading involves the exchange of one currency for another, and currencies are traded in pairs (e.g., EUR/USD, GBP/JPY). Each pair consists of a base currency and a quote currency. For example, the quotation EUR/USD 1.07350 is the price of the euro expressed in US dollars, which means that 1 euro equals 1.07350 US dollars (This price is at the time when this blog was created).

CFD

XM forex broker offers CFD which is Contract of Difference. It is a popular form of derivative trading that allows traders to speculate on the rising or falling prices of global financial markets or instruments. This allows you to speculate on the price movements of stocks without owning the underlying asset. XM allows to trade wide range of instruments like Forex, Commodity, Shares, Indices, and Cryptocurrencies.

Indices

XM Broker offers a wide range of financial instruments for trading, including indices. Indices are a popular trading instrument because they represent the performance of a group of stocks from a particular market or sector, allowing traders to speculate on the overall movement of the market rather than individual stocks. NASDAQ 100, S&P 500, UK100, GER30, AUS200 are some popular indices available on XM broker.

Stocks

XM Broker offers a variety of financial instruments for trading, including a wide range of stocks. XM provides access to numerous global stock markets, allowing traders to invest in stocks from various sectors and regions. XM offers access to stocks from major global exchanges, including the NYSE, NASDAQ, LSE, and more. This provides traders with a diverse range of opportunities, access to global markets, competitive spreads, and leveraging opportunities.

Commodities

XM trades, The forex trading broker offers a range of commodities for trading. These commodities can be broadly classified into three main categories: metals, energies, and agricultural products.

Metals

In XM trading Broker provides Metals like Gold (XAUUSD), Silver (XAGUSD), Copper (XCUUSD), Platinum (XPTUSD), Palladium (XPDUSD) to allows you to trade in the market and gives diverse option to invest in the instruments. These instruments will give huge growth in the future if you invest in present life period.

Energies

XM Broker allows traders to trade in Crude Oil, Natural Gas (NGAS). These instruments are the most traded one on commodities which as high liquidity and more volatile. It is the best instruments for traders to make profit.

Cryptocurrencies

XM offers a diverse range of cryptocurrencies for trading. Traders can access major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH) on the XM platform. These cryptocurrencies are available for trading as Contracts for Difference (CFDs), allowing traders to speculate on price movements without owning the underlying asset.

Account Option

XM Broker offers a variety of account types to cater to different trading styles and preferences. Whether you are a conservative trader or a high-risk speculator, XM provides accounts with varying leverage options to suit your risk tolerance and trading strategy. It is essential for traders to choose the right account type based on their goals and risk appetite.

Micro Account

XM Provides Micro Account suitable for beginners, allows trading in micro lots which 0.01 that minimize the risk of losing huge capital.

Standard Account:

XM Provides Standard Account designed for more experienced traders, offers standard lot trading which allows traders to trade in high volumes and make huge profit.

Ultra Low Standard Account:

XM provides Ultra Low Standard Account provides ultra-low spreads starting from 0.6 pips, with no commission on trades. So it motivates traders to trade more as their is no commission and low spread.

Islamic Accounts

XM provides Islamic Accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against Islamic faith. They offer Islamic accounts to clients following the Muslim faith.

Charges and Commission

XM Broker makes money by charging spreads on all trades. A spread is the difference between the bid and ask price of an instrument. For example, if the bid price for EUR/USD is 1.1200 and the ask price is 1.1205, the spread is 5 pips. XM Trading also charges commissions on CFD trades. A commission is a fee that is charged for opening and closing a CFD trade. The commission rate varies depending on the instrument being traded.

News and Analysis Center

The XM Broker, The forex trading Broker offers you the best service provides you the fully guided that evolved the right information of up to date with company news market analysis, trading ideas are provide you with full knowledge about it. It also provides important notifications about bank holidays. These are the information that provided by the XM broker.

Awards and Accolades

XM Broker, The forex trading broker provides the best trading platform that they have achieved several awards that includes Best Forex Global Customer Service, Best CFD Provider, Best Forex Trading Support, Best Forex Broker in Europe, Australasia, Latin America, and the Middle East, and Most Reliable Broker globally and many more…

Customer Support

Having reliable customer support is crucial when it comes to trading, as you may encounter technical issues or have questions about your account. So, how does XM Trading’s customer support hold up?

Reliable customer support is essential for resolving queries, technical issues, and account-related concerns in a timely manner. Traders should choose brokers with responsive customer support channels such as live chat, email, and phone support to receive assistance whenever needed during their trading activities.

XM Trading broker offers 24/5 customer support through various channels, including live chat, email, and phone. The broker also provides multilingual support in over 30 languages, which is beneficial for clients from different countries.

Overall, XM Trading’s customer support is prompt, efficient, and knowledgeable, making it a reliable option for traders.

Why Choose XM ?

XM Global Limited, The forex trading Broker that offers you exclusive service available in India and globally, is the best and most authentic trading platform around the world. It provides 1000+ instruments to trade in different market segments. It is Registered under Tier 1 Regulator in Cyprus.

The Registration process is so easy and can be completed within minutes. As per the regulator rule, XM should verify their client’s account, so they ask us to upload the required documents to complete the registration process.

After registration, you can log in to your XM account and make your required deposit (minimum deposit of $5). You can also avail a bonus of up to 50% on the initial deposit of your capital that XM gives you as a welcome gift, which helps the speculators and trades to trade in high volume and make huge profits.

They also provide a demo account to get practical experience and back-test your strategies in the real market. It helps beginners to get practice in trading.

XM provides an enhanced trading platform for traders to trade seamlessly best trading experience with XM web trading on MT-4, MT-5. It also provides you with software and mobile applications for better trading experience. So the users can get more features and advanced trading tools to analyze the market.

XM provides multiple ways to deposit money from our trading account. As XM provides service in India they also accept UPI transactions, which is very convenient for Indian users to transfer money. They also provide other platforms like Skrill, Neteller, Bank Transfer (Net Banking), and debit/credit cards.

The withdrawal will be directly transferred to the bank account of the clients. The withdrawal transfer process will be from 1-5 business days. Mostly the money withdrawn will be transferred within a day.

The Safety and Security of the platform and the data of the clients are highly secured by XM. They give maximum security to the trading platform and update the security regularly.

XM provides copy-trading services to clients. Using it, you can copy the open position of an experienced trader based on your analysis of the person you choose to copy their trades. XM is not responsible for any losses to your account on this copy trading. Depending on the person you choose to copy trade, different charges may apply.

XM provides educational content to get more knowledge in trading. It provides educational video content, live classes, and webinars on forex trading for beginners.

XM provides 24/5 Customer support through various channels, including live chat, email, and phone. The broker also provides multilingual support in over 30 languages, which is beneficial for clients from different countries. In India, they give customer support in their regional language also. This is one of the major advantage for Indian clients to resolve their issues.

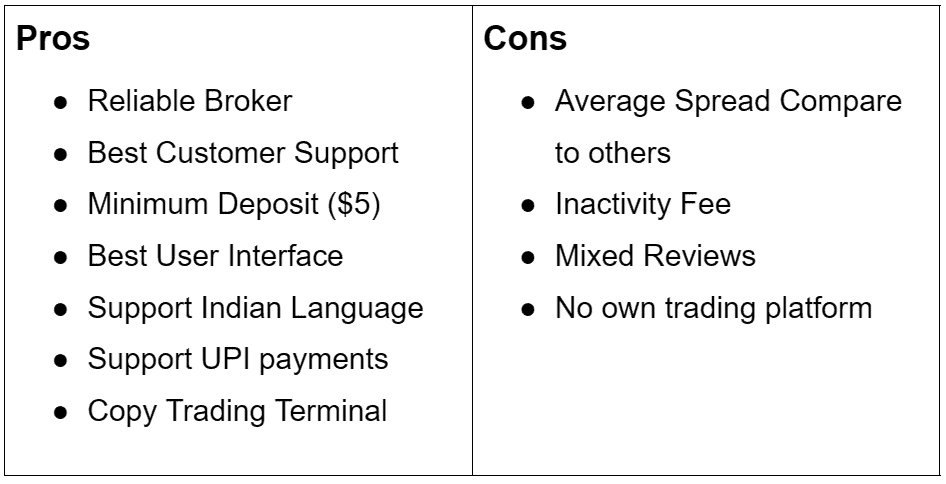

Pros and Cons

Conclusion

In conclusion, XM Trading is a reputable and reliable broker with a wide range of trading instruments, competitive fees, and excellent customer support. The Overall review of XM is good, based on the resources available and research made on XM. They are giving great service to Indian traders to be profitable. They are one of the top broking service providers globally. Overall, XM Trading is a solid option for traders looking for a regulated and trusted broker with a global presence. So it is definitely worth considering and a best decision for your forex trading in India.

To open Account with XM Click Here…

To know More details About XM, you can contact Classroom of Traders.

FAQs

Is XM legal in India?

XM is Not legal in India. Unfortunately, XM is not regulated by RBI or SEBI, Due to some of the regulation followed in India. But XM follows all the Terms and norms of RBI and provide service to Indian traders.

Is XM Broker safe in India?

Yes, XM is safe in India. They are also regulated by Tire 1 Regulators in Cyprus. They give best customer support in regional language in India.

Is XM real or fake?

XM broker is legit. They are regulated by Tire 1 Regulator in Cyprus. They are giving best service to the traders globally.

Is XM a good broker?

Yes, XM is very good and safe service providing broker globally. They are providing more trading instruments and advance trading platform for traders to trade.

What is the minimum deposit for XM?

The minimum deposit to trade in XM trading platform is $5. But it is suggestable to make minimum deposit of $100 to trade seamlessly.

This blog helps me to understand the XM forex broker.

After reading this blog I decided to trade with XM and it would be the best choice for me. This platform is so easy to access.

Thank you Classroom of Traders, for sharing about XM Forex Broker.