Ava Trade in India

AvaTrade is an online trading platform and brokerage firm offering its global customers access to financial markets including forex and Contracts-for-Difference (CFD) trading in shares, bonds, indices, ETFs, commodities, and cryptocurrencies. It was founded in 2006 by Emanuel Kronitz and Negev Nosatzki, in the Republic of Ireland.

AvaTrade has its administrative headquarters in Dublin, Ireland, and regional offices in Mexico, Johannesburg, Chile, Mongolia, Dublin, Milan, Tokyo, Abu Dhabi, and Sydney.

AvaTrade’s client base grew to more than 300,000 traders across 150 countries – including Italy, Spain, Germany, Brazil, United Arab Emirates, Sweden, Finland, South Africa, Australia, China, Russia, Poland, Hungary, and Chile. It reports some two million trades monthly, representing around £60 billion in volume.

AvaTrade is a good choice for traders in India. The broker complies with all the requirements of the local regulator and offers attractive trading conditions for the clients.

AvaTrade has been providing services at the market and to the client’s for more than 17 years and during this time it has become one of the leading companies. It is consistently on the list of the Best Forex brokers in India and globally.

The broker diligently fulfills its obligations towards the customers and regulatory authorities, implementing innovations in its activity, and is constantly working to improve its quality of service to the customer.

Table of Contents

Regulator

AvaTrade is regulated by several well-respected international regulatory bodies. All of the below bodies provide protection over clients’ funds by ensuring the activities and the safety and security that they are kept in separate bank accounts.

- Australian Securities and Investments Commission (ASIC) in Australia (License number: 406684)

- Central Bank of Ireland (CBI) – Central Bank of Ireland (Reference No.: C53877)

- Financial Services Agency (FSA) in Japan (License number: 1662)

- Financial Futures Association of Japan (FFAJ) – (License number: 1574)

- Financial Sector Conduct Authority (FSCA) in South Africa (Registration number: 45984)

- B.V.I Financial Services Commission in the British Virgin Islands (License: SIBA/L/13/1049)

- Polish Financial Supervision Authority (KNF) in Poland (License number: 693023)

- Israel Securities Association (ISA)

- Abu Dhabi Global Market Authorities (ADGM)

AvaTrade in India is not regulated by the regulating authorities of India. But AvaTrade follows all the rules and norms that RBI has issued. Indian traders who engage in AvaTrade Broking must ensure compliance with the following regulations:

- Know Your Customer (KYC): Traders are required to complete the KYC process by submitting documents such as proof of identity, address, and bank account details to verify their identity.

- Foreign Exchange Management Act (FEMA): Traders must abide by the FEMA regulations when investing in foreign exchange trading and adhere to the limits set by the RBI for overseas investments.

- Tax Reporting: Traders are obligated to report their foreign exchange earnings and pay taxes on the profits generated from AvaTarde Broker trading.

By following these regulations and guidelines, Indian traders can legally engage in AvaTrade without facing any legal consequences.

Financial Trading Instruments

AvaTrade offers customers forex and CFD trading in more than 750 financial instruments. AvaTrade offers it products to traders into six categories: Forex, Indices, Shares, ETFs, Commodities, and Cryptocurrencies.

Forex Trading With AvaTrade

AvaTrade provides its traders with access to more than 50 forex pairs, including all the major currency pairs, minors and exotics. Eg: EUR/USD, USD/JPY, GBP/USD, AUD/USD, EUR/CHF and many more.

Index CFDs

Contract For Difference (CDFs) allow traders or speculator to trade on the price of assets without actually owning them in their accounts. AvaTrade offers CFD markets on 19 stock indices like S&P 500, Nasdaq 100, Nikkei225, China 50, Dollar Index, ect.,

CFDs On Shares

AvaTrade currently offers more than 100 different stocks to traders that are Apple, Google, Tesla, Amazon, Coca Cola, Twitter and many more.

Commodity

AvaTrade offers to the customer to trade in commodity market instruments like Gold, Silver, Oil, Natural Gas, Copper, Sugar, Platinum, etc.,

Cryptocurrency

AvaTrade provides services to trade in Cryptocurrency like Bitcoin, Bitcoin Cash,Ethereum, Neo, Bitcoin Gold, and many more.

AvaTrade offers to trade in Bonds and ETFs through CFDs to the customers provides a wide range of investment opportunity.

Charges and Commission

AvaTrade makes money from the spreads and commissions it charges on each trade and any additional fees such as overnight trading and inactivity.

Trading Fees

AvaTrade uses a spread-only fee model, providing a simplified fee structure that doesn’t impose additional charges for trading major assets.

Account Fee

AvaTrade does not burden traders with account maintenance fees, enhancing its cost-effectiveness.

Inactivity Fee

The broker enforces an inactivity fee after three consecutive months of non-trading activity.

Overnight Trading Fee

AvaTrade charges an overnight funding (or swap) fee for positions held overnight. Traders can find the details directly on the platform.

Trading Platform

AvaTrade offers trading platforms with advanced tools and features to enhance the trading experience for both novice and experienced traders. From customizable charting tools to automated trading strategies and real-time market data, traders can make informed decisions and execute trades efficiently and quickly through Avatrade platform.

AvaTrade provides trading platforms through Ava WebTrader, Ava Options on both web and mobile Platform, MT4 and MT5 Platform for seamless and better trading experience for the users.

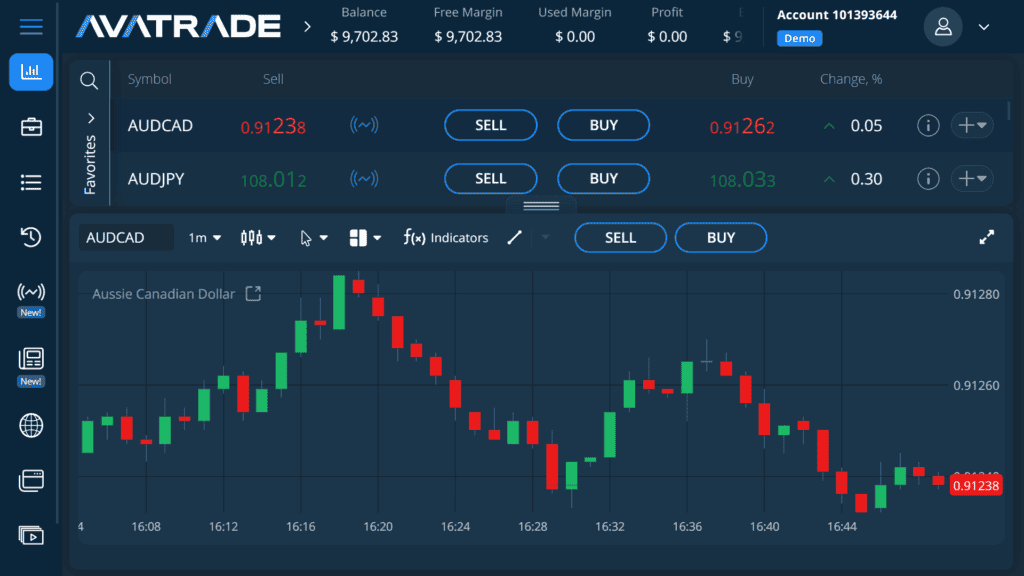

Ava WebTrader Platform

Ava WebTrader, a AvaTrade own trading platform provides the convenience of trading from any device without the need to download the software or application. They provide the best trading interface, quick order execution, one click buy and sell, customizable charting tools, multiple windows for more analysis in one screen.

Ava Web Trader also provides free trading signals on their platform to their client’s to make profit. It’s an added advantage for ava client’s to make use of it. Before you take the signals, do your own analysis for a better outcome. Ava is not responsible for any loss on using their signal. It is only for education purposes provided for their clients.

Ava Web trading also provides services like instant news on market, educational content for beginners, forex calculator, top analyst views, economic calendar, and tutorial videos. It is one of the Best and Unique Platform for users to trade through it.

AvaOptions

AvaOptions is an option trading platform where most of the broking firms don’t have this service. AvaTrade provides its unique and most advanced option trading platform on its web portal and in AvaOptions application. Traders who are most interested in options trading can choose AvaOptions for option trading, it is the best and most convenient platform for option traders in forex trading.

AvaOption provides traders with more advanced tools and option strategies to analyze the market. The best thing that AvaOption provides is the user interface. We can make all the necessary order executions in one window. Such as choosing stick price, setting limit orders, Stop loss, and target orders all in one go. It also provides information on how much the market will move on the particular stick price, and how much profit we can make when entering a trade.

The Minimum quantity to trade option is 10000 which is 1 mini lot (0.1). You can directly execute option strategies in the chart and execute the trade. Strategies like Call and Put Spread, Straddle, Strangle, Butterfly, Iron condor. These Strategies will apply in the chart and you can also customize how to want and trade in options.

They also provide tutorial videos on their option trading platform to understand how to use and trade in options through their platform. AvaOption Provides dedicated Risk Management tools to protect the capital. So traders can make use of the tools to reduce losses according to the risk willing to take by them.

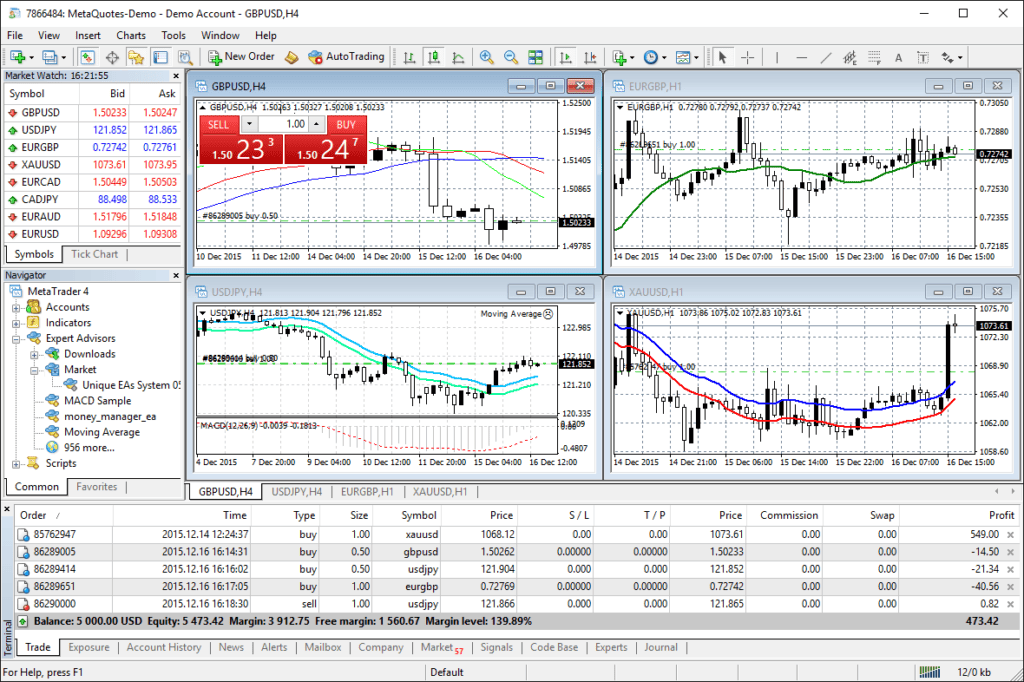

MT4

MetaTrader 4 (MT4) is a widely-used electronic trading platform developed by MetaQuotes. MT4 is a popular trading platform offered by Avatrade, one of the Top leading brokerage firms Globally. MetaTrader 4 is ideal for traders who prioritize robust charting tools and automated trading for both novice and experienced traders. If you’re comfortable with a slightly older interface but value reliability and extensive community support, MT4 is a solid choice. It is available in PC, MAC, Android and IOS.

MT5

MetaTrader 5 (MT5) is the same as trading platform like MT 4. MT 5 is an advanced trading platform offered by Avatrade Best Forex Broker Globally, providing an enhanced and advanced trading experience compared to MetaTrader 4. AvaTrade integrates MT5 to offer advanced trading features, comprehensive analysis tools, and a seamless trading environment. MT5 offers enhanced features such as additional order types, more timeframes, and an economic calendar. If you’re looking for advanced tools and a modern interface, MT5 might be the better option. MT5 is available in PC, Mac, Android and iPhone.

AvaTrade also provides Automated Trading Platforms that are ideal for traders who prefer algorithmic trading. If you have a strong technical background and want to leverage automated strategies, AvaTrade’s support for APIs and trading robots to automate your trades.

Account Types

Retail Accounts

AvaTrade provides Retail accounts designed for individual traders who are starting or continuing their trading journey. These accounts provide access to a wide range of trading instruments, including forex, commodities, indices, stocks,CFDs and cryptocurrencies.

In this Account the leverage is Up to 1:30 for major forex pairs, in accordance with regulatory requirements.

The Minimum Deposit requirement to trade in Avatrade is $100.

Competitive spreads, with no commissions on trades.

AvaTrade offers negative balance protection and AvaProtect, allowing clients to take out insurance on a trade. It gives alert to the customer to exit the trading when it goes loss or to increase the capital to avoid auto square off.

Professional Accounts

AvaTrade also provides Professional accounts for experienced traders who meet specific criteria set by regulatory bodies and the broker. These accounts offer higher leverage and additional benefits compared to retail accounts.

This Account provides features like leverage Up to 1:400

Even more competitive spreads, with no commissions on trades.

Access to advanced trading tools and analytics.

Personalized support from a dedicated account manager.

Islamic Accounts

Islamic accounts, also known as swap-free accounts, are designed for traders who adhere to Islamic finance principles, which prohibit earning interest on trading positions held overnight.

Features of this account, No swap or rollover fees on positions held overnight

Access to the same range of trading instruments as other account types,

Minimum deposit requirement is $100,

Competitive spreads, with no commissions on trades.

Demo Accounts

Demo accounts are perfect for beginners who want to learn and practice trading or those who want to test their strategies without risking real money. These accounts simulate real trading conditions using virtual funds.

Features of this account

Demo Account is for 21 days only. It comes with a pre-loaded amount of virtual money. Simulates real-time market conditions. Ideal for learning and practicing trading strategies. No risk of losing real money, making it safe to learn.

Deposit

AvaTrade supports several deposit methods, including credit/debit cards, bank wire transfers, and e-wallets like Skrill, AstroPay, and Neteller. With AvaTrade maintaining a no-deposit fee policy, additional charges may only come from the payment gateway.

AvaTrade requires a minimum deposit of $100, which is higher than other brokers. But it is also a safe way for traders to make money management and position risk management strategies.

Withdrawals

Like the deposit channels, customers can process withdrawals using the payment options same as available for deposit. Withdrawals usually take 1 business days to complete, and there are no withdrawal fees, offering users complete access to their profits. However, you should pay attention to potential fees from the payment service providers like e-wallets.

My Suggestion is, you can use AstroPay payment gateway for deposit and withdrawal purpose. Because AstroPay is giving great service and minimal fee for transaction.

To Open Account with AstroPay Click Here…

Educational resources

AvaTrade provides educational resources for beginners to learn about trading strategies and forex trading. It provides basic to advanced level resources to get full knowledge on forex trading. It helps the beginner traders to kick start their trading journey.

Copy Trading

AvaTrade offers customers copy and social trading with AvaSocial, ZuluTrade, DupliTrade, and MQL5 Signal service. AvaTrade provides Copy Trading to customers through DupliTrade platform where the customer can choose himself a copy trader provider by the Risk and Return ratio, Charge, Monthly returns that the professional traders provided in the platform. AvaTrade is not responsible if any loss occurred due to taking copy trade.

Trading Signal

AvaTrade offers Trading Signals in Ava WebTrader proprietor platform, Which gives customers Buy and Sell signals. So they can make use of this signal to make profit. The Profit or Loss in trading is common in trading, so better do your analysis before taking the signals provided.

Customer Support

AvaTrade offers customers dedicated 24/5 customer support in 15 languages. Traders can contact the AvaTrade customer service support team by phone, email, and live chat.

Unfortunately, AvaTrade does not support Indian regional languages. It is a big drawback for Indian traders to open an account or get their queries solved easily.

The website and platform are available in 24 different languages, including Dutch, English, Finnish, French, Italian, German, Korean, Spanish, Portuguese, Arabic, Russian, Chinese, Swedish, and Turkish. So traders globally can be accessed easily.

Safety and Security

The Safety and Security of the platform and the data of the clients are highly secured by AvaTrade. They give maximum security to the trading platform and trading account and update the security regularly.

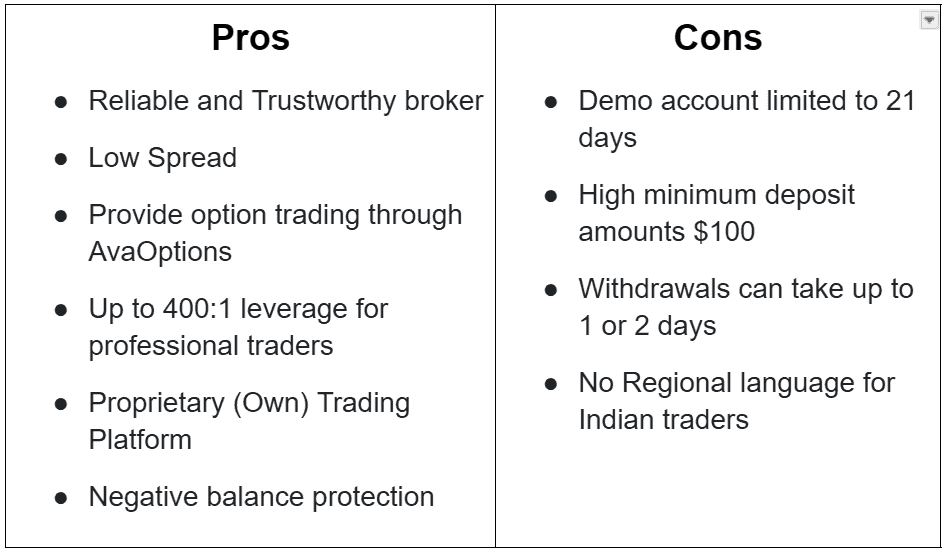

Pros and Cons

Conclusion

In Conclusion, AvaTrade broking is the top and most reliable and reputable broking firm that has given service for more than 17 years and it is regulated under 7 regulators globally. So it is a trustworthy broker and provides a wide range of trading instruments, competitive fees, and excellent customer support. It gives excellent service to Indian traders. They are one of the top broking service providers globally. Overall, AvaTrade is a best choice for traders looking for a regulated and trusted broker with a global presence. So it is definitely worth considering and a best decision for your forex trading in India.

Address and Phone Number of AvaTrade in India

To get the service of AvaTrade in India, you can contact the Classroom of Traders.

Classroom of Traders is the sub-broker of AvaTrade providing broking service for the forex traders in India. If you have any queries feel free to contact us.

Adderss

18 A, VOC St, Om Sakthi Nagar, Kaikankuppam, Valasaravakkam, Chennai, Tamil Nadu, India 600087

Mobile No: 99622 34448

Whatsapp us: +91 9962234448

To open Account with AvaTrade Click Here…

Also Classroom of Traders provides Trading Courses, Practical Training, Money Management Technique, Trading Floor, Research Analysis, and all types of trading related programs.

To know More details About Trading Course, you can contact Classroom of Traders.

FAQs

Is AvaTrade is available in India?

Yes, AvaTarde is available in India. AvaTrade is tied up with Classroom of Traders to provide services to forex traders in India. If you want to know more information about AvaTrade contact Classroom of traders.

Is AvaTrade is safe and legit?

AvaTrade is highly safe platform and it is regulated by top tier regulators globally. It is the legitimate company providing a trustworthy service to customers and maintain proper records as directed by the regulators.

Is AvaTrade is legal in India?

Unfortunately AvaTade is not legal in India as their is certain norms provided by the government. But as instructed by RBI, AvaTrade follows all the rules and norms to provide service to the Indian traders.

What is the minimum deposit for AvaTrade?

The minimum deposit to trade in AvaTrade is $100. It is high deposit compare to the other broking service providers. But it one of the added advantage for trader to trade with high leverage and make huge profit.

Does AvaTrade required KYC?

Yes AvaTrade ask their client’s to upload identification documents to verify the customer details before start trading.

Is AvaTrade a good forex broker in India?

AvaTrade is the top and most reliable broker service provider globally. It is regulated by top tier regulator in the world. They are giving more than 500 instruments in different segments to trade in the market. They are giving best service to the traders.

Before reading this blog I had a lot of confusion in my mind about choosing the correct trading platform. But now I am clear.

Thank you for sharing this blog about Avatrade. This is a wonderful platform.