Top 5 Best Forex Brokers in India

Forex trading, also known as foreign exchange trading, has increasing popularly in recent years, attracting both new and experienced traders. This global market operates 24 hours a day, allowing traders to buy, sell, and exchange on currencies.

However, the success of a forex trader largely depends on the choosing the right broker. A reliable and efficient forex broker can provide the necessary tools, resources, and support to help traders to get to know about complexities of the forex market.

In India, RBI maintains a strict regulatory framework for Forex brokerages and all foreign exchange activity. For this reason, many Indian Forex traders prefer to trade with international brokers rather than those brokers based in India.

Choosing the right forex broker is crucial for anyone looking to succeed in this field. Factors such as regulation, trading platforms, fees, customer support, and educational resources play a significant role in determining the overall trading experience.

In this blog, we will see about the top 5 forex brokers in India, providing their features, strengths, and uniqueness between them. Whether you are a experienced trader or beginner, this guide will help you make an decision and choose the best forex broker to meet your trading needs.

Table of Contents

How to Choose the Best Forex Broker?

Regulator

Choose the broker who is registered with high tier reputable Financial Regulator. This is probably the single most important factor in choosing a Forex broker. If they are registered with tier 1 regulator, they will be following all the rules and norms issued by the regulator. So your fund deposited will be high secured and safe with the broker.

Trading Assets

Many brokers provide wide range of trading instruments like forex, CFDs in Stocks and Index, Commodity, and Cryptocurrencies. So Choose the broker who provide wide range of trading instruments so it will helps you to trade in different instruments to make more profit.

Leverage

Leverage means allowing a trader to control a large amount of capital with a smaller amount of money deposited in their account. The more leverage a broker offers, the larger the trade sizes you can place. However, using too much leverage is very risky, so it is important to strike a balance between risk and potential reward.

Commissions, Spreads, and Fees

Commissions and spreads (the difference between the bid and ask prices) will be your main cost as a trader. Many brokers provide low spread, no commission, zero trading account fee. It is considerable to choose the broker who provides low Commissions, Spreads, and Fees.

Trading Platforms

Broker will provide best trading platform for seamless trading experience. The execution of trades fast, hassle-free, and transparent, gives the quality of the platform. They provide their own trading platform or they will give access to trade your account in other common trading platform like MT4, and MT5. These platform gives you access to the markets, research and data, and more. Whichever trading platform you choose should be very stable.

Account Types

Many Forex brokers offer different account types depending on how you want to execute your trades and the lot size of your trade. Some Broker provides Standard Account or Micro Account to reduce the cost of spread for traders to trade with high volume and make more profit. It is your choice to choose which type of account you need to trade.

Minimum Deposit

Every broker limit their own minimum deposit for trader to trade efficiently in the market. It varies from $0 to $100 or more. So choose the broker who gives you minimum deposit at your convenient.

Trading App

It is important to see that the broker is providing the multiple facility to trade the market. They provide Trading Software and Trading apps to trade at your convenient and seamless trading.

Customer Service

Strong customer service can resolve queries efficiently and quickly. You want to ensure you can access your Forex broker’s customer service at hours that are convenient for you, and that you can reach them by both email and phone.

Top 5 Forex Brokers in India

Now let see the top 5 Forex Brokers in India which provide high quality service and offer competitive spreads, tight liquidity, and excellent customer service. They also provide a wide range of trading tools and resources to help traders make informed decisions. The Top 5 Forex Brokers are:

1) AvaTrade

2) XM Global Limited

3) FXTM

4) Exness

5) Interactive Brokers

AvaTrade

AvaTrade is an online trading platform and brokerage firm offering its global customers access to financial markets including forex and Contracts-for-Difference (CFD) trading in shares, bonds, indices, ETFs, commodities, and cryptocurrencies. It was founded in 2006 by Emanuel Kronitz and Negev Nosatzki, in the Republic of Ireland.

AvaTrade is a good choice for traders in India. The broker complies with all the requirements of the local regulator and offers attractive trading conditions for the clients.

| Features | Information |

| 🏛️ Regulation | ASIC, FAS, CBI, ISA, ADGM, CySEC |

| 💻 Trading Accounts | Standard Account Professional Account Demo Account Islamic Account |

| 📊 Trading Platforms | MT4, MT5, Ava WebTrader, AvaOption |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex CFD Indices Shares Commodities Cryptocurrencies Futures Options |

| 💵 Leverage | 30:1 |

| ➕ Bonuses for traders? | 20% Bonus on initial deposit |

| 📈 Minimum spread | 0.03 pips |

| 💸 Copy Trading | AvaSocial, ZuluTrade, DupliTrade |

| 💻 Demo Account | ✅ Yes |

| ☪️ Islamic Account | ✅ Yes |

| 📞 Customer Support | 24/5 |

| ⭐ Rating | ⭐⭐⭐⭐ (4.5 out of 5) |

| 👉 Open Account | Click Here… |

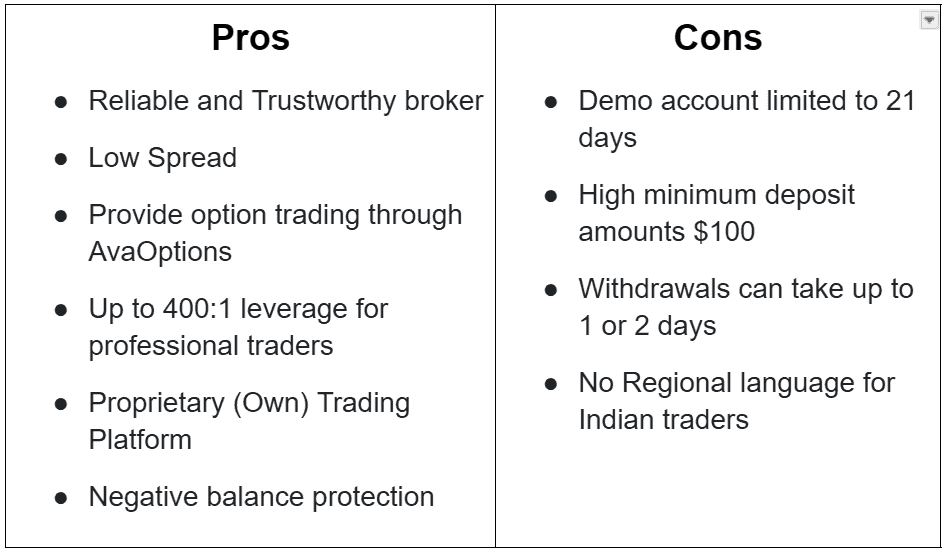

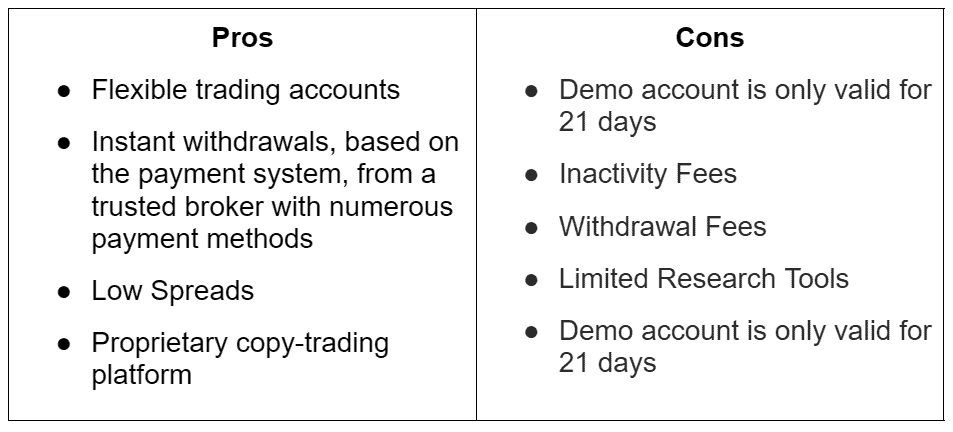

AvaTrade Pros and Cons:

XM Global Limited

XM Global Limited is an online forex and CFD broker initiated in Cyprus in 2009 by Constantino’s Cleanthous. The company headquartered in Cyprus and is regulated by the CySEC (Cyprus Securities and Exchange Commission). It is also highly regulated by tier 1 regulators. XM trades is most trusted trading online platform, you can trade anywhere in world. Let see what are the services that XM broker provides.

| Features | Information |

| 🏛️ Regulation | CySEC, FSC, ASIC, IFSC, DFSA |

| 💻 Trading Accounts | Micro Account Standard Account Ultra Low Standard Account Islamic Accounts |

| 📊 Trading Platforms | MT4, MT5 |

| 💰 Minimum Deposit | $5 |

| 📉 Trading Assets | Forex CFD Indices Shares Commodities Cryptocurrencies |

| 💵 Leverage | 1:1000 |

| ➕ Bonuses for traders? | 50% Bonus on initial deposit |

| 📈 Minimum spread | 0.6 pips |

| 💻 Demo Account | ✅ Yes |

| ☪️ Islamic Account | ✅ Yes |

| 📞 Customer Support | 24/5 (Indian Regional Language) |

| ⭐ Rating | ⭐⭐⭐⭐ (2.5 out of 5) |

| 👉 Open Account | Click Here… |

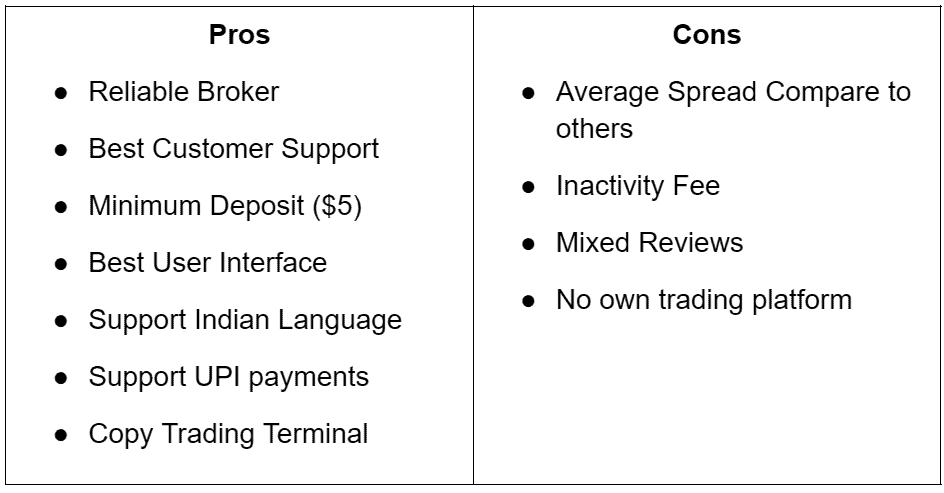

XM Pros and Cons:

FXTM

FXTM is an international CFD and forex broker was Established in 2011, which has quickly grown into a global brand serving over 2 million customers. FXTM is regulated by the Cyprus Securities and Exchange Commission (CySec) and holds a Cyprus Investment Firm (CIF) license. FXTM is a trusted, award-winning broker for forex trading.

| Features | Information |

| 🏛️ Regulation | CMA, CySEC, FCA, FSC Mauritius, FSCA |

| 💻 Trading Accounts | ADVANTAGE ADVANTAGE PLUS Demo Account Pro Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 Proprietary platform |

| 💰 Minimum Deposit | $200 |

| 📉 Trading Assets | Forex CFD Indices Shares Commodities |

| 💵 Leverage | 1:3000 |

| ➕ Bonuses for traders? | 30% Bonus on initial deposit |

| 📈 Minimum spread | 0.1 pip |

| 💻 Demo Account | ✅ Yes |

| ☪️ Islamic Account | ✅ Yes |

| 📞 Customer Support | 24/5 |

| ⭐ Rating | ⭐⭐⭐⭐(3.3 out of 5) |

| 👉 Open Account | Click Here… |

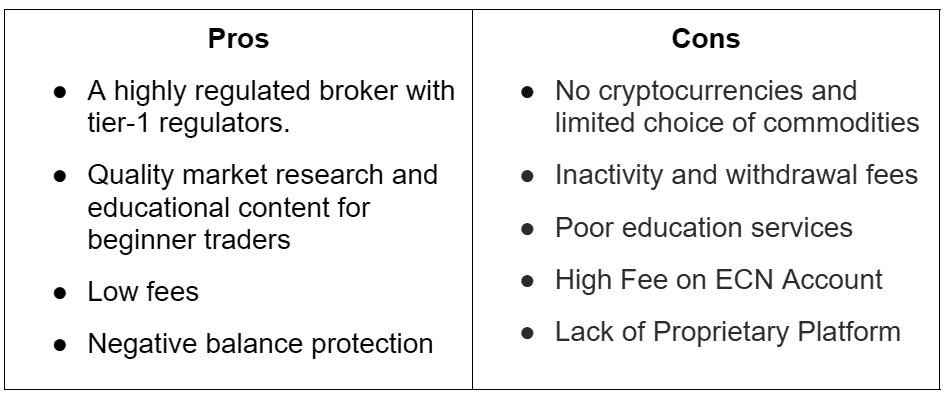

FXTM Pros and Cons:

Exness

Exness is a leading global forex and CFD broker, established in 2008. Regulated by top-tier authorities. Exness offers a wide range of trading instruments, including forex, metals, cryptocurrencies, and more. The broker provides advanced trading platforms like MT4 and MT5, instant withdrawals, comprehensive educational resources, and 24/7 customer support, making it a popular choice for traders worldwide.

| Features | Information |

| 🏛️ Regulation | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA, BVI |

| 💻 Trading Accounts | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account Demo Account Islamic Account |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness App |

| 💰 Minimum Deposit | $10 |

| 📉 Trading Assets | Forex Commodities Stocks Indices Cryptocurrencies |

| 💵 Leverage | 1:500 |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | 0.3 pips |

| 💻 Demo Account | ✅ Yes |

| ☪️ Islamic Account | ✅ Yes |

| 📞 Customer Support | 24/7 |

| ⭐ Rating | ⭐⭐⭐⭐(4.8 out of 5) |

| 👉 Open Account | Click Here… |

Exness Pros and Cons:

Interactive Brokers

Interactive Brokers, founded in 1977 by Thomas Peterffy, is a leading electronic brokerage firm at the forefront of trading technology. Interactive Brokers stands out as an optimal choice for traders in India seeking a well-regulated brokerage for trading on the Bombay Stock Exchange (BSE) and under the supervision of the Securities Exchange Board of India (SEBI).

| Features | Information |

| 🏛️ Regulation | FINRA, IIROC, FCA, CSSF, CBI, MNB, ASIC, SFC, MAS, SEBI |

| 💻 Trading Accounts | IBKR Lite, IBKR Pro |

| 📊 Trading Platforms | IBKR Trading Platform |

| 💰 Minimum Deposit | $10 |

| 📉 Trading Assets | Forex Stocks ETFs Options Futures Indices Mutual funds Cryptocurrencies Commodities Bonds |

| 💵 Leverage | 1:400 |

| ➕ Bonuses for traders? | Yes |

| 📈 Minimum spread | 0.6 pips |

| 💻 Demo Account | ✅ Yes |

| ☪️ Islamic Account | ❌ No |

| ⭐ Rating | ⭐⭐⭐⭐(3.4 out of 5) |

| 👉 Open Account | Click Here… |

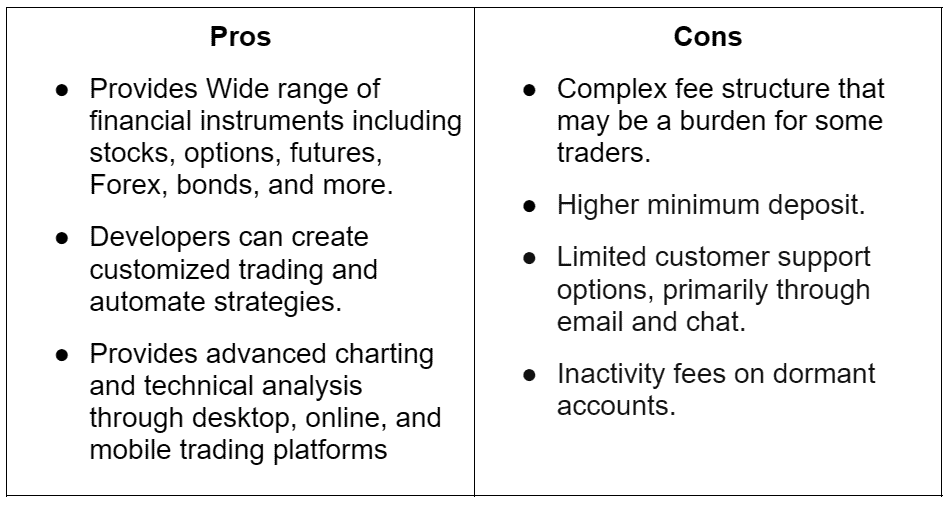

Interactive Brokers Pros and Cons:

Conclusion

Finally Choosing the right Forex broker will lead to the best trading path, the safety and security of our funds, a better user interface for the trading platform, and seamless service from the broker. Go through the guidance given above and analyze all the features and charges that brokers provide for a suitable choice. Therefore, choose the right forex broker according to your perception and for the convenience of your trading journey.